FAQs on Master Directions on Priority Sector Lending Guidelines

FAQs on Master Directions on Priority Sector Lending Guidelines

A. Computation of Adjusted Net Bank Credit (ANBC)

Query 1: How to adjust PSLC buy/PSLC sale in the computation of ANBC?

Clarification: The net PSLC outstanding (PSLC Buy minus(-) PSLC Sell) is added to the Net Bank Credit, as mentioned in para 6 of the Master Directions on PSL, 2020 (updated from time to time). Further, a PSLC remains outstanding until its expiry (s. no. ix of Notification on Priority Sector Lending certificates dated April 07, 2016, All PSLCs will expire by March 31st and will not be valid beyond the reporting date (i.e. March 31st), irrespective of the date it was first bought/sold. Accordingly, the effect of PSLC buy is increase in ANBC and conversely the effect of PSLC sell is decrease in ANBC and the net of PSLC buy/sell is adjusted to the ANBC for every quarter. Thus, a PSLC bought or sold in any quarter will have to be taken into account in all subsequent quarters till the end of the FY to which it pertains.

Query 2: The Face Value of securities acquired and kept under HTM category under the TLTRO 2.0 (Press Release 2019-2020/2237 dated April 17, 2020 read with Q.11 of FAQ and SLF-MF- Press Release 2019-2020/2276 dated April 27, 2020 and also Extended Regulatory Benefits under SLF-MF Scheme vide Press Release 2019-2020/2294 dated April 30, 2020 are permitted to be excluded from computation of Adjusted Net Bank Credit (ANBC) for the purpose of determining Priority Sector Lending target/sub-targets. How this exclusion is to be made?

Clarification: The Master Directions on Priority Sector Lending, 2020 under para 6 provides for computation of Adjusted Net Bank Credit. The face value of securities availed under TLTRO 2.0 and SLF-MF (including the Extended Regulatory Benefits) are to be reduced (as given in ‘IX’ of para 6.1 of the Master Directions on PSL). Since these securities are considered as HTM investments, the banks have to add them as Bonds/debentures in Non-SLR categories under HTM category (as given in ‘X’ of para 6.1 of the Master Directions on PSL). It is envisaged that the Priority Sector Lending target/sub-targets should not increase on account of securities acquired under TLTRO 2.0 and SLF-MF (including the Extended Regulatory Benefits). By adding the face value of securities (X) and reducing the face value of securities (IX) there will be no increase in ANBC due to investments in TLTRO 2.0 and SLF-MF (including the Extended Regulatory Benefits.)

Query 3: Whether the deposits with DFIs viz., NABARD, SIDBI, MUDRA & NHB on account of PSL shortfall can be counted towards achievement of PSL / targets/ sub-targets and ANBC?

Clarification: Banks can reckon outstanding deposits with NABARD under Agriculture and overall PSL achievement, while deposits with SIDBI, MUDRA and NHB can be reckoned only for overall PSL achievement. Banks should also add these deposits to Net Bank Credit (NBC) for computation of Adjusted Net Bank Credit (ANBC).

However, deposits with NABARD, SIDBI, MUDRA and NHB cannot be reckoned for sub-target achievement viz. SMF, NCF, Micro and weaker section.

Query 4: In terms of paragraph 3 of the circulars DBOD.No.Ret.BC.36/12.01.001/2013-14 dated August 14, 2013, and DBOD.No.Ret.BC.93/12.01.001/2013-14 dated January 31, 2014 banks were advised that advances extended in India against the incremental FCNR (B) / NRE deposits, qualifying for exemption from CRR / SLR requirements under the above circular, will be excluded from the Adjusted Net Bank Credit (ANBC) for computation of priority sector lending targets, till their repayment. What is the method of arriving at the extent of such advances?

Clarification: i. In terms of circular under reference, the amount eligible for exclusion from ANBC is the incremental advances extended out of the resources generated from the eligible incremental FCNR (B) / NRE deposits. The incremental advance is calculated as the difference between outstanding advances in India as on March 7, 2014 and the Base Date (July 26, 2013).

ii. The amount to be excluded from ANBC for computation of priority sector target will of course not exceed incremental FCNR (B) / NRE deposits eligible for exemption from maintenance of CRR / SLR in terms of circulars under reference.

iii. In case, the difference in amount of outstanding advances between March 7, 2014 and base date is zero or negative, no amount would be eligible for deduction from ANBC for the purpose of arriving at the priority sector lending targets.

Query 5: Are banks permitted to exclude bills purchased/discounted/negotiated (payment to beneficiary not under reserve) while calculating the ‘Bank Credit in India’?

Clarification: The bills purchased/ discounted/ negotiated (payment to beneficiary not under reserve) under LC is allowed to be treated as Interbank exposure only for the limited purpose of computing exposure and capital requirements. It should not be excluded from the computation of ‘bank credit in India’ [As prescribed in item No.VI of Form ‘A’ under Section 42(2) of the RBI Act, 1934] which allows for exclusion of interbank advance. While exposure may be to the LC issuing bank, the bills purchased/discounted amounts to bank credit to its borrower constituent. If this advance is eligible for priority sector classification, then bank can claim it as PSL. Banks have to take note of the above aspect while reporting Net Bank Credit in India as well as computing the Adjusted Net Bank Credit for PSL targets and achievement

B. Adjustment for Weights in PSL Achievement

Query 6: How will the incremental weights be calculated as per revised guidelines?

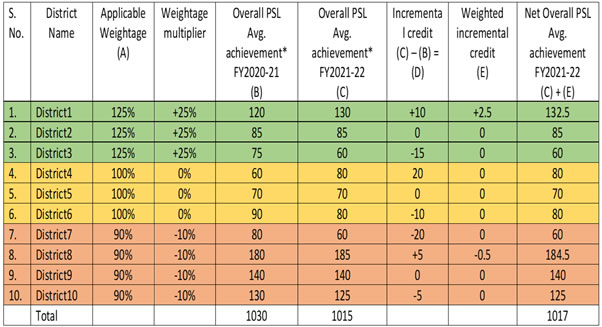

Clarification: As detailed in Para 7 of the Master Directions on Priority Sector lending, 2020 on “Adjustments for weights in PSL Achievement”, differential weightage in the incremental credit to the priority sector areas shall be reckoned from FY 2021-22 onwards. There will be 125% weightage on incremental credit to select 184 districts with low per capita PSL credit and 90% weightage on incremental credit to select 205 districts with high per capita PSL credit. The incremental weights will be calculated on targets/ sub-targets. Accordingly, the allocation to RIDF and other funds shall be done on the basis of total shortfall, including the shortfall calculated on incremental credit as per prescribed differential weights.

Query 7: Will the weights be applicable in case of decline in credit or negative incremental credit?

Clarification: If there is a decline in credit, the weighted incremental credit will be zero (0). The methodology as given below will be considered for all the districts for which data is reported in ADEPT. The banks are requested to get in touch with our Statistics Division (fiddstats@rbi.org.in) regarding the format for submission of returns under ADEPT, in case the same have not been submitted till date by the bank. Further, based on the methodology detailed above, banks are expected monitor their own PSL achievement during the year taking into account the prescription of differential weights for credit disbursed in identified districts, for the purpose of trading in PSLCs.

* Avg. achievement will be the average of four quarters of a year, as on reporting dates of QPSA. Similar calculations will be done for other PSL targets.

Query 8: What is the criteria for mapping credit to a particular district?

Clarification: For mapping a credit facility to a particular district, the ‘Place of utilization of Credit’ shall be the qualifying criteria.

Query 9: In case of achieving priority sector through indirect routes viz. PSLCs, IBPCs, On-lending, Securitization, Assignment etc., the place of utilization may not be available on ADePT for mapping the individual account level data. How will the incremental credit be calculated in such case?

Clarification: While calculating district-wise incremental credit for assigning weights, the organic credit i.e. only the credit directly disbursed by banks and for which the actual borrower/beneficiary wise details are maintained in the books of the bank will be considered. Credit disbursed through the following inorganic routes shall not be considered for incremental weights.

- Investments by banks in securitised assets

- Transfer of Assets through Direct Assignment /Outright purchase

- Inter Bank Participation Certificates (IBPCs)

- Priority Sector Lending Certificates (PSLCs)

- Bank loans to MFIs (NBFC-MFIs, Societies, Trusts, etc.) for on-lending

- Bank loans to NBFCs for on-lending

- Bank loans to HFCs for on-lending

C. Agriculture

Query 10: Can bank loans against gold be classified under priority sector?

Clarification: The PSL guidelines are activity and beneficiary specific and are not based on type of collateral. Therefore, bank loans given to individuals/ businesses for undertaking agriculture activities do not automatically become ineligible for priority sector classification, only on account of the fact that underlying asset is gold jewellery/ornament etc. It may, however, be noted that as per FIDD Circular dated February 7, 2019 and updated from time to time, it has been advised that banks may waive margin requirements for agricultural loans upto ₹1.6 lakh. Therefore, bank should have extended the loan based on scale of finance and assessment of credit requirement for undertaking the agriculture activity and not solely based on available collateral in the form of gold. Further, as applicable to all loans under PSL, banks should put in place proper internal controls and systems to ensure that the loans extended under priority sector are for approved purposes and the end use is continuously monitored.

Query 11: Can loans given to landless individuals engaged in allied activities be classified under priority sector lending (SMF category)?

Clarification: Bank loans up to ₹2 lakh to individuals solely engaged in allied activities without any accompanying land holding criteria are entitled for classification under SMF category of priority sector lending. Further, farmers availing loans under SMF (based on land holding) are also eligible for loans under allied activities upto ₹2 lakhs and the same can be also be classified under SMF category

Query 12: What due diligence should banks ensure while classifying loans under PSL-Agriculture/SMF?

Clarification: Bank should ensure proper documentation for classifying agricultural loans under PSL as approved by their board. Particularly while classifying loans under agriculture/SMF category, the bank should maintain details regarding location where the borrower is tilling the land, details of crop grown, hypothecation of crops, if any, sanction of loan based on scale of finance, record of field visit by bank officials to monitor end use of agricultural loans, etc. Some of the above aspects should be available with the bank in the absence of copy of land record/lease deed particularly in case of agriculture loans to landless labourers’, share croppers etc.

Query 13: How should the banks ensure adherence to the credit cap of ₹100 crore from banking system, while extending credit to activities under ‘Agriculture Infrastructure’ or ‘Food & Agro-Processing’ categories?

Clarification: As per extant guidelines, loans for Agriculture Infrastructure or loans for Food & Agro-processing activity are each subject to an aggregate sanctioned limit of ₹100 crore per borrower from the banking system. In case aggregate exposure across the banking industry exceeds the limit of ₹100 crore, then total exposure will cease to be classified under PSL category. The sanctioned limit of ₹100 crore has to be ascertained facility wise for a particular entity and is exclusive of the other borrowings of the entity for PSL / non-PSL purposes. However, it needs to be ensured that the bank has assessed and sanctioned separate limits for the specific purpose of Agriculture Infrastructure or Food & Agro Processing activities of the entity to qualify as PSL. Banks should take a declaration from the borrower regarding loan sanctioned by any other bank/s for the same activity and also independently seek confirmation from those banks. In the scenario, where new sanction by the bank leads to overall limit across banks to more than ₹100 crore, it needs to inform other banks too about the same. Accordingly, all other banks need to declassify the same from PSL.

Query 14: Loans are extended to Cargo Companies, Shipping Companies, Roadlines Co., Transport Cos, Logistic Cos., Movers and Carriers etc. for purchasing Commercial Vehicles. These transport and shipping companies act as a Carrier (‘Transporter’) for such Enterprises which are into food and agro processing business. Whether bank loans to such a transporter who acts as a ‘carrier’ and does not have any food and agro processing set-up themselves, are eligible for classification under priority sector.

Clarification: As per Annex-III of Master Directions on Priority Sector Lending (PSL) dated September 4, 2020, transportation is an eligible activity under indicative list of permissible activities under Food Processing Sector. However, while classifying any facility to transporters for purchasing Commercial Vehicles under “Food & Agro-processing” category, it needs to be ensured that the transporter is using the vehicle exclusively for transportation of food & agro-processed products or is a type of vehicle which is specifically used for “Food & Agro-processing” e.g. cold storage trucks, vans etc. If the commercial vehicle is also used for transportation of products other than those related to food & agro processing, the facility shall not be eligible for classification under ‘Food & Agro-processing’ category. In such cases, the same may be classified under MSME (Services), if it meets the conditions prescribed for the same in our Master Direction on PSL.

Query 15: Can bank loans extended to companies for buying commercial vehicles be eligible for classification under “Agriculture Infrastructure” category of priority sector?

Clarification: While classifying any facility to transporters for purchasing Commercial Vehicles under “Agriculture Infrastructure” category, it needs to be ensured that the transporter/ sub-contractor is using the vehicle exclusively for activities that are ancillary to “Agriculture Infrastructure”. If the commercial vehicle is also used for transportation for purposes under non-agriculture infrastructure category, the facility shall not be eligible for classification under ‘Agriculture Infrastructure’. In such cases, the same may be classified under MSME (Services), if it meets the conditions prescribed for the same in our Master Direction on PSL.

D. MSME

Query 16: Whether the continuity of the PSL status for 3 years is still applicable to MSMEs that have breached the threshold limit as per the new definition of MSMEs?

Clarification: Government of India (GoI), vide Gazette Notification S.O. 2119 (E) dated June 26, 2020 and updated from time to time, has notified the new composite criteria of investment in plant & machinery as well as turnover for classification of an enterprise under MSME. Under the composite criteria, if an enterprise crosses the ceiling limits specified for its present category in either of the two criteria of investment or turnover, it will cease to exist in that category and be placed in the next higher category but no enterprise shall be placed in the lower category unless it goes below the ceiling limits specified for its present category in both the criteria of investment as well as turnover. Based on the new definition, the earlier criteria regarding continuity of PSL status for three years even after an enterprise grows out of the MSME category concerned, is no longer valid.

E. Export Credit

Query 17: What is the permissible cap for export credit under priority sector lending?

Clarification: Bank lending to export credit under agriculture and MSME sectors is classified as PSL under the respective categories viz, agriculture and MSME and there is no cap on credit for the same. Export Credit (other than in agriculture and MSME) is classified as priority sector as per the following table:

| Domestic banks / WoS of Foreign banks/ SFBs/ UCBs | Foreign banks with 20 branches and above | Foreign banks with less than 20 branches |

| Incremental export credit over corresponding date of the preceding year, up to 2 per cent of ANBC or CEOBE whichever is higher, subject to a sanctioned limit of up to ₹40 crore per borrower. | Incremental export credit over corresponding date of the preceding year, up to 2 percent of ANBC or CEOBE whichever is higher. | Export credit up to 32 per cent of ANBC or CEOBE whichever is higher. |

Query 18: While calculating cap on Export Credit, whether it can be averaged over four quarters of a financial year?

Clarification: With effect from FY 2020-21 all banks are allowed to compute the eligible portfolio under Export Credit by averaging across four quarters, to determine adherence to the prescribed caps i.e. 32 percent for Foreign Banks with less than 20 branches and 2 percent for others. The cap on exports is based on ANBC/CEOBE of Current FY.

F. Education

Query 19: In the revised PSL guidelines, ₹20 lakh is referred to Outstanding Limit or Sanctioned Limit?

Clarification: Only such loans that are within the sanctioned limit of ₹20 lakh shall be eligible for priority sector classification.

Query 20: If the same borrower is having multiple education loans with different opening dates before and after 04-09-20, which value is required to be considered under PSL (0/s of ₹10 lakhs per borrower or Limit of ₹20 lakhs per borrower). For instance, Student had an education loan of ₹12 Lakhs prior to 04.09.2020, then avails second education loan of ₹18 Lakhs after 04.09.2020, how PSL outstanding will be calculated for this particular customer?

Clarification: For the loans sanctioned before September 4, 2020, outstanding value up to ₹10 lakh, irrespective of the sanctioned limit, shall continue to be classified under priority sector till maturity. However, while reckoning any fresh loan under PSL to a borrower who had already availed education loan from the bank prior to September 4, 2020, it needs to be ensured that the aggregate sanctioned limit does not exceed ₹20 lakh for classification of the loans under PSL.

In the mentioned scenario, as the combined sanctioned limit becomes ₹30 lakh, the ₹18 lakh loan extended after September 4, 2020 shall not be eligible for PSL classification. However, with regard to the ₹12 lakh loan, which was already PSL as per earlier guidelines, the outstanding value under the facility, up to ₹10 lakh shall continue to be eligible under PSL till maturity.

Query 21: Under revised PSL guidelines, sanctioned limit has been capped at ₹ 20 lakhs. If a customer is sanctioned a loan of ₹20 lakhs and the outstanding amount becomes ₹22 Lakhs, in such a scenario whether entire outstanding will be reckoned for PSL?

Clarification: The outstanding value may exceed ₹20 lakh on account of accrued interest due to moratorium on repayment during study period. Accordingly, the entire outstanding amount shall be reckoned for priority sector provided the sanctioned limit does not exceed ₹20 lakh.

Query 22: If a student avails two education loans after September 4, 2020 for ₹12 lakhs and ₹18 lakhs, how PSL will be calculated for this particular customer?

Clarification: Post September 4, 2020, if the aggregate sanctioned limit of multiple education loans either from a bank or across banks to a single borrower exceeds ₹20 lakh limit, all loans of the borrower sanctioned after September 4, 2020 shall become ineligible for PSL classification. In this regard, banks should take a declaration from the borrower regarding education loan sanctioned by any other bank/s and also independently seek confirmation from those banks.

G. Social Infrastructure

Query 23: How is PSL classification considered for lending to Social Infrastructure activities viz. Schools etc. (prescribed limit of ₹5 crore) and Health Care Facilities (prescribed limit of ₹10 crore) which can also be classified as MSME (Service) based on definition as per MSME Act.

Clarification: As per Udyam Registration Portal- NIC Codes, under Services as ‘Major Activity’, ‘Education’ & ‘Health Activities’ are eligible activities for classification under MSME (Services). Therefore, bank loans for above purposes can be classified under MSME (Services), wherein no cap on credit has been prescribed. However, banks can classify such activities either under MSME (Services) or Social Infrastructure, and not under both. It may be noted that for classification under Social Infrastructure, the associated cap on credit shall be applicable.

H. Weaker Sections

Query 24: In case of Partnership Firms/ Pvt. Limited, can the loan granted be tagged as SMF and Weaker Section, if any of the Partner/ Director is holding Agriculture land upto 2 hectares / 5 acres.

Clarification: As per extant guidelines, SMF includes individuals, SHGs, JLGs, Farmers’ Producer Companies (FPC) and Co-operatives of farmers with the accompanying criteria of membership by number and land-holding. Therefore, loans to partnership firms/ co-borrowers or any director of a Company holding Agriculture land upto 2 hectares / 5 acres are not eligible to be classified under the Small and Marginal farmers category of PSL

Query 25: In case of a Partnership firm, if majority of the partners belong to one or the other of the specified minority communities, whether advances granted to such partnership firms can be treated as advances granted to minority communities. Further, in case of Private / Public Ltd. Company, if any of the borrowers belong to Minority Community, can the loan be classified under weaker section category?

Clarification: As per extant guidelines, priority sector loans are eligible for classification as loans to minority communities as per the list notified by the GoI from time to time. The same may be read with Master Circular- Credit Facilities to Minority Communities which under para 2.2 states “In the case of a partnership firm, if the majority of the partners belong to one or the other of the specified minority communities, advances granted to such partnership firms may be treated as advances granted to minority communities. Further, if the majority beneficial ownership in a partnership firm belongs to the minority community, then such lending can be classified as advances to the specified communities. A company has a separate legal entity and hence advances granted to it cannot be classified as advances to the specified minority communities.”

Query 26: Can banks rely on customer’s declaration for Minority / SC / ST category to be included under Weaker section?

Clarification: Our guidelines do not mandate banks to obtain documentary evidence for classifying credit facilities to Minorities and SCs/STs under weaker section. Therefore, declaration by the customer in the application form would suffice. However, it needs to be ensured that for classification under weaker sections, the loans should first be eligible for classification under priority sector lending as per underlying activity.

I. Investment by Banks in securitized assets / Transfer of Assets through Direct Assignment/ Outright Purchase

Query 27: How should banks ensure due diligence to ascertain priority sector status of PTC portfolio?

Clarification: The bank may rely on a CA certificate by the originating entity certifying the PSL composition of the pool. Additionally, bank may conduct a sample check of say 10% of the pool for PSL eligibility. The additional check may be conducted by the bank through its own staff or by engaging a CA for this purpose.

J. PSLCs

Query 28: How can banks register for PSLC trading?

Clarification: The banks are required to submit a request to FIDD, CO (fiddplan@rbi.org.in) to obtain registration for PSLC trading by submitting a) DEA Fund Code b) Customer identification number and c) RBI Current account number.

Query 29: What is the expiry date of PSLC?

Clarification: All PSLCs will be valid till end of FY i.e. March 31st and will expire on next day i.e. April 1st.

Query 30: Whether PSLCs can be issued for a limited period i.e., for one reporting quarter and multiples thereof?

Clarification: The duration of the PSLCs will depend on the date of issue with all PSLCs being valid till end of FY i.e. March 31st and expiring on next day i.e. April 1st.

Query 31: Whether service tax/ stamp duty/ transaction tax will be applicable while paying fee for PSLC?

Clarification: PSLCs may be construed in the nature of ‘goods’ in the course of inter-state trade or commerce, dealing in which has been notified as a permissible activity under section 6(1)(o) of BR Act vide Government of India Notification dated May 4, 2016. GST on PSLCs for the period July 01, 2017 to May 28, 2018 has to be paid by the seller bank on forward charge basis at the rate of 12%. With effect from May 28, 2018, GST has to be paid by the buyer bank under Reverse Charge Mechanism (RCM) at the rate of 18%. Further, IGST is payable on the supply of PSLC traded over e-kuber portal. If a bank which was liable to pay GST had already paid CGST/SGST or CGST/UGST, the bank is not required to pay IGST towards such supply. Further, as per the extant guidelines, no transaction charge/ fees is applicable on the participating banks payable to RBI for usage of the PSLC module on e-Kuber portal.

(The clarification given above is not a legal advice or opinion in the matter and it may not necessarily reflect the most current legal developments. The market participants should seek the advice of the tax experts/consultants/specialists before acting upon any of the information provided above).

Query 32: Whether PSL – Weaker Sections or PSL – Export Credit can be traded as PSLCs?

Clarification: There are only four eligible categories of PSLCs i.e. PSLC General, PSLC Small and Marginal Farmer, PSLC Agriculture & PSLC Micro Enterprises.

Query 33: Whether Export Credit may form a part of PSLC ‘General’ and whether banks’ surplus in Export Credit can be sold as PSLC ‘General’?

Clarification: ‘Export Credit’ can form a part of underlying assets against the PSLC – General. However, any bank issuing PSLC-General against ‘Export Credit’ shall ensure that the underlying ‘Export Credit’ portfolio is also eligible for priority sector classification by domestic banks.

Query 34: Are Foreign Banks with less than 20 branches permitted to buy PSLC-General for achieving the target of 8% of lending to ‘other than exports’?

Clarification: Foreign banks with less than 20 branches are not allowed to buy PSLC General for achieving their 8% target of lending to sectors other than exports. However, such banks are allowed to buy PSLC Agriculture, PSLC Micro Enterprises and PSLC Small and Marginal Farmer for the same.

Query 35: Where can the banks look for market information like prevailing prices, lot size, and historical transactions done by other market participants? Will this information be available in E-Kuber?

Clarification: The trade summary of PSLC market is available to the participants through the e-Kuber portal. Any new functionality will be notified to the participants via ‘News & Announcements’ section under e-Kuber portal.

Query 36: Can a purchasing bank re-sell PSLCs? Will only the net PSLC position be reckoned for ascertaining the underlying asset?

Clarification: A bank can purchase PSLCs as per its requirements. Further, a bank is permitted to issue PSLCs upto 50 percent of previous year’s PSL achievement without having the underlying in its books. This is applicable category-wise. The net position of PSLCs (PSLC Buy – PSLC Sell) has to be considered while reporting the quarterly and annual priority sector returns. However, with regard to ascertaining the underlying assets, as on March 31st, the bank must have met the priority sector target by way of the sum of outstanding priority sector portfolio and net of PSLCs issued and purchased.

Query 37: What happens if the RBI inspection team, at a later date, de-classifies a particular PSLC (which has been already traded by the bank as PSLC) ineligible?

Clarification: The misclassifications, if any, will have to be reduced from the achievement of PSLC seller bank only. There will be no counterparty risk for the PSLC buyer, even if, the underlying asset of the traded PSLC gets misclassified.

Query 38: The buyer would pay a fee to the seller of the PSLC which will be market determined. Is there any standard/ minimum fee prescribed by the RBI, for purchase of any PSLC?

Clarification: The premium will be completely market determined. No floor/ ceiling has been prescribed by RBI in this regard.

Query 39: How the charges/commission shall be paid through E-Kuber portal or separate RTGS is required to be made?

Clarification: There will be real time settlement of the matched premium and accordingly respective current accounts of the participating banks with RBI will be debited/ credited to the extent of matched premium

Query 40: Will there be automatic matching of trades or can the buyer/seller select the counterparty? Will partial matching also happen?

Clarification: The order matching will be done on anonymous basis through the portal and the buyer/ seller cannot select the counterparty. Partial matching will happen depending on the matching of premium and availability of category wise PSLC lots for sale and purchase.

Query 41: What are the timings of PSLC market in eKuber portal?

Clarification: The normal trading hours shall be from 10 AM to 4:30 PM. The PSLC market operates on all days except Saturdays, Sundays, holidays declared under The Negotiable Instruments Act, 1881 by the Government of Maharashtra. and such holidays as RBI may declare from time to time.

Query 42: Can a bank know the counterparty details in PSLC trades or settle deals on bilateral basis and report the same on e-kuber portal subsequently?

Clarification: The nature of PSLC trading has been kept anonymous to maintain most efficient price discovery. There is no provision for settling deals on bilateral basis and reporting on the portal subsequently. RBI has the discretion to cancel any deals which is settled at substantially higher/ lower premiums as compared to the prevailing rates on the portal.

K. On-lending under Priority Sector

Query 43: While lending to intermediaries for on-lending to priority sector, can the bank reckon the total outstanding loan to the NBFCs / MFIs / HFCs towards its priority sector achievement.

Clarification: In the case of bank’s lending to NBFCs / MFIs / HFCs for on-lending, only that portion of the portfolio should be reckoned for PSL classification that has been disbursed by the NBFC / MFI / HFC to the ultimate borrower/s as on the reporting date. The reckoning of residual portfolio, if any, can be done on subsequent reporting dates, based on the disbursement of eligible loans and reported by the NBFC / MFI / HFC to the bank.

Query 44: What is the methodology to be followed by a bank for lending to eligible entities for on-lending to priority sector?

Clarification: The Master Directions on Priority Sector Lending, 2020 under para 21, 22, 23 allows banks to classify as PSL its lending to NBFCs including HFCs and NBFC-MFIs and other MFIs (Societies, Trusts etc.) which are members of RBI recognised SRO for the sector for on-lending to eligible priority sectors. Banks may adopt a uniform methodology for on-lending as follows:

a) Classification under PSL:

• The banks can classify on-lending to NBFC in the respective categories of PSL. The classification will be allowed only when the NBFC has disbursed the Priority Sector Loans to the ultimate beneficiary after receiving the funds from the bank.

• The NBFCs must provide a CA certificate to the banks stating that the individual loans of the portfolio, against which on-lending benefit is being claimed, are not being used to claim benefit from any other bank(s). Also, NBFC must put in place a suitable process to flag such loan(s) in their systems to enable its internal/statutory auditors as well as RBI supervisors to verify the same.

b) Information sharing:

• The banks may devise internal control mechanisms to ensure that the portfolio under on-lending is PSL compliant and adheres to co-terminus clause. The same should be made available to RBI supervisor/s as and when required. The following information/record should be collected by the bank from the EI:

- Name of the beneficiary, Amount sanctioned, Loan amount outstanding, Loan tenure, disbursement date, category of PSL.

- A statement to the effect that the portfolio is PSL compliant must be certified by a CA and shared by the EI with the bank on a quarterly basis in line with the PSL reporting by the bank to RBI. With respect to adherence to the co-terminus clause, the bank should ensure the same as on March 31 each year.

c) Adherence to co-terminus condition:

• The banks availing benefit of on-lending for PS assets must adhere to the condition that the tenure of the loan under on-lending to an EI is broadly co-terminus with the tenure of PS assets created by the EI.

• In view of the operational difficulties of exactly matching the co-terminus duration, the banks are allowed a variance of 3 months from the portfolio duration. An illustration for calculating adherence to the co-terminus duration is given below:

In the above illustration, the residual maturity of bank loan to NBFC should be around 22.22 months. Banks are expected to calculate the weighted average residual maturity of portfolio ever year as on March 31 and ensure that residual maturity of bank loan to NBFC matches with the weighted average residual maturity of on-lending portfolio within the tolerance limit of +-3 months.

d) Treatment of pre-payment, foreclosure loans:

- The PS assets created by the entity may undergo pre-payment or foreclosure thereby changing the ‘weighted maturity’ of the portfolio.

- As the banks are required to calculate ‘weighted maturity’ at the end of FY, the loan outstanding in the event of pre-payment/foreclosure will also change accordingly.

- The NBFC may add PS assets to the on-lending portfolio. However, it must meet conditions mentioned above such as disbursements for the PS asset by the eligible entity must be on/after receipt of funds from the bank. The addition of PS assets to the portfolio pool can also be done in case of pre-payment/foreclosure of other PS assets in the pool to ensure adherence to the co-terminus clause.

Query 45: What is the cap for bank lending to NBFCs and HFCs for on-lending?

Clarification: Bank lending to NBFCs (other than MFIs) and HFCs are subjected to a cap of 5% of average PSL achievement of the four quarters of the previous financial year. In case of a new bank the cap shall be applicable on an on-going basis during its first year of operations. The prescribed cap is not applicable for bank lending to registered NBFC-MFIs and other MFIs (Societies, Trusts, etc.) which are members of RBI recognised ‘Self-Regulatory Organisation’ of the sector. Bank lending to such MFIs can be classified under different categories of PSL in accordance with conditions specified in our Master Directions FIDD.CO.Plan.BC.5/04.09.01/2020-21 dated September 04, 2020 and updated from time to time.

L. Co-lending by Banks & NBFCs

Query 46: Whether Co-lending Arrangement allows NBFCs to retain 100% of the risk?

Clarification: While the guidelines allow sharing of risks and rewards between the bank and the NBFC for ensuring appropriate alignment of respective business objectives, the priority sector assets on the bank’s books should at all times be without recourse to the NBFC.

Query 47: Are direct assignment of assets applicable only where bank can exercise its discretion?

Clarification: Only if the bank can exercise its discretion regarding taking into its books the loans originated by NBFC as per the Agreement, the arrangement will be akin to a direct assignment transaction. If the Agreement entails a prior, irrevocable commitment on the part of the bank to take into its books its share of the individual loans as originated by the NBFC, it shall not be akin to direct assignment transaction.

Query 48: Does the term “Mandatorily” in CLM guidelines means that the bank must take all the loans originated by NBFC or a cap can be affixed on the number and amount in the Master Agreement.

Clarification: Both entities, the bank & the NBFC shall be guided by the bilateral Master Agreement entered by them for implementing the Co-lending Model (CLM). The agreement may state any cap on the number and amount of loans that can be originated by the NBFC under the Co-lending model.

Query 49: What will be the fate of loans originated by NBFC, which do not qualify under due diligence checks to comply with RBI regulations on KYC and Outsourcing of activities.

Clarification: If the Agreement entails a prior, irrevocable commitment on the part of the bank, it has been advised that the partner bank and NBFC shall have to put in place suitable mechanisms for ex-ante due diligence by the bank. Such due diligence should ensure compliance with RBI regulations on KYC and outsourcing of activities before disbursal of the loans by the NBFC.

Query 50: Does the term back-to-back mean loan accounts will first be opened by NBFC and thereafter bank will open loan accounts in its books or both will open loan accounts and fund them simultaneously based on the loan agreement signed by the borrower with the NBFC.

Clarification: Back-to-back basis implies that the loans will be first opened by NBFC and then bank will open loan accounts subsequently.

Query 51: Based on the loan documents executed, will the NBFC sanction and disburse the whole amount and thereafter approach the bank for reimbursement or will it sanction/ disburse its part of the loan and then approach the bank to sanction/ disburse its part.

Clarification: The bank and the NBFC can decide on this aspect as per the Master agreement between them.

Other Updates on RBI