Additional Payment Mechanism (i.e. ASBA, etc.) for Payment of Balance Money in Calls for partly paid specified securities issued by the listed entity

1.SEBI, in its endeavour to protect investors’ interest and reduce investor grievances relating to refund, introduced Application Supported by Blocked Amount (ASBA) as the sole payment mechanism in the IPO and Rights issues.

2.Considering that payment through ASBA mechanism is investor friendly and enables faster completion of the process, it has been decided to introduce additional payment mechanism(i.e. ASBA, etc)for making subscription and/or payment of calls in respect of partly paid specified securities through SCSBs and intermediaries such as Trading Members/ Brokers -having three in one type account and Registrar and Transfer agents (RTA).

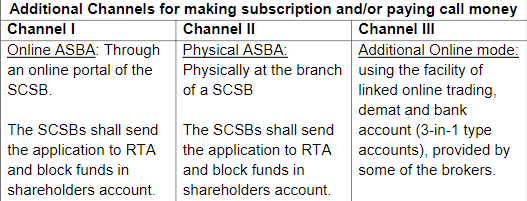

3.Additional Channels for making subscription and/or paying call money

3.1For the purpose of making payment of balance money for calls in respect of partly paid specified securities, the additional channels are tabulated below:

4.Period of subscription: The payment period for payment of balance money in Calls shall be kept open for fifteen days.

5.Disclosures in the Letter of Offer: The intermediaries including the issuer company and its RTA shall provide necessary guidance to the specified security holders in use of ASBA mechanism while making payment of calls.

6.This circular shall be applicable for all Call Money Notice wherein the payment period opens on or after January 01, 2021.

7.Stock Exchanges are directed to:

7.1 take necessary steps to put in place systems for implementation of the circular, including necessary amendments to the relevant bye-laws, rules and regulations;

7.2take necessary action to institute additional payment channels (electronic banking modes only) for making subscription and/or paying call money in respect of partly paid up specified securities.

7.3bring the provisions of this circular to the notice of the listed companies and their members and also disseminate the same on their websites;

8.The circular is issued in exercise of the powers conferred under sections 11 and 11A of the Securities and Exchange Board of India Act, 1992 read with Regulations 88 and 299 of SEBI(Issue of Capital and Disclosure Requirements) Regulations, 2018.