Alignment of interest of Asset Management Companies (‘AMCs’) with the Unitholders of the Mutual Fund Schemes

- Securities and Exchange Board of India (Mutual Funds) (Second Amendment) Regulations, 2021 (‘MF Amendment Regulations’) was notified on August 05, 2021 (https://www.sebi.gov.in/legal/regulations/aug-2021/securities-and-exchange-board-of-india-mutual-funds-second-amendment-regulations-2021_51695.html) and the provisions of the said Regulations will come into force on the 270th day from the date of notification.

- As per the amended regulations i.e. sub-regulation 16(A) in Regulation 25 of SEBI (Mutual Funds) Regulations,1996 (‘MF Regulations’), asset management companies (‘AMCs’) are required to invest such amount in such scheme(s) of the mutual fund, based on the risk associated with the scheme, as may be specified by the Board from time to time.

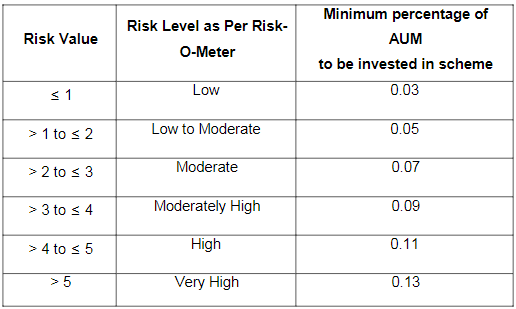

- Accordingly, it is decided that based on the risk value assigned to the scheme(s) , in terms of SEBI circular no. SEBI/HO/IMD/DF3/CIR/P/2020/197 dated October 5, 2020, AMCs shall invest minimum amount as a percentage of assets under management (‘AUM’) in their scheme(s) as provided in the Annexure.

- For the purpose of para 3 above:

a) The risk value of the scheme as per the risk-o-meter of the immediate preceding month shall be considered.

b) The investment shall be maintained at all points of time till the completion of tenure of the scheme or till the scheme is wound up.

c) AMCs shall, except in case of close ended scheme(s) , conduct a quarterly review to ensure compliance with the requirement of investment of minimum amount in the scheme(s) which may change either due to change in value of the AUM or in the risk value assigned to the scheme. Further, based on review of quarterly average AUM, shortfall in value of the investment in scheme(s), if any, shall be made good within 7 days of such review. AMC shall have the option to withdraw any excess investment than what is required pursuant to such review.

d) AMCs may invest from their net worth or the sponsor may fund the AMC to fulfil the aforesaid obligations, if required. However, the AMCs shall be required to make good the shortfall in the minimum networth to comply with the requirement of the MF Regulations in case of sustenance of temporary Mark to Market loss for two consecutive quarters. AMC shall ensure that such temporariness of the Mark to Market loss is certified by the statutory auditor.

e) AMCs shall not be required to invest in ETFs, Index Funds, Overnight Funds, Funds of Funds scheme(s) and in case of close ended funds wherein thesubscription period has closed as on date of coming into force of MF Amendment Regulations. - The mandatory contribution already made by the AMCs in compliance with the applicable MF Regulations shall not be withdrawn. However, such contribution canbe adjusted against the investment required by the AMC as per this circular.

- The compliance of the provisions of this circular shall be ensured by the AMCs and monitored by the Trustees. Any non-compliance in this regard, shall be reported in the Quarterly CTR and half-yearly Trustee Report.

- Details of investment by AMCs in each of their mutual fund scheme(s) shall be disclosed on the website of AMCs and AMFI.

- The provisions of this circular shall come into force on the date of applicability of the MF Amendment Regulations as referred under para 1 of this circular. SEBI circular SEBI/HO/IMD/DF4/CIR/P/2020/100 dated June 12, 2020 shall stand rescinded from such date.

- This circular is issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992 and Regulation 77 of SEBI (Mutual Funds) Regulations, 1996, to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

Annexure

Percentage of AUM to be invested in the scheme of Mutual Fund based on the risk value of the respective scheme

Read More on SEBI