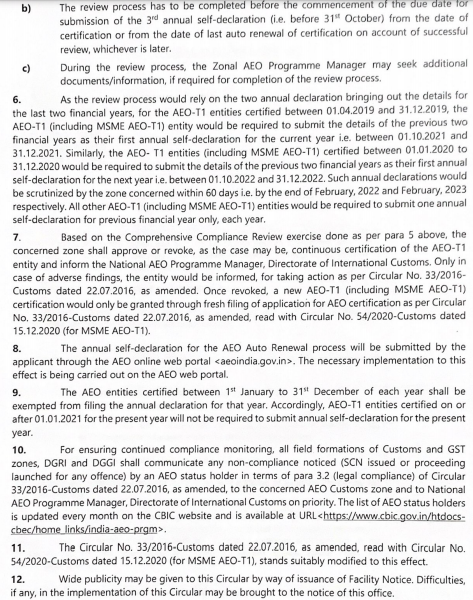

ANNUAL SELF-DECLARATION

(A) General Information

| Entity Legal Name | |

| Whether the AEO Status Holder is a Manufacturer or Trader? | |

| Whether the AEO Status Holder is an MSME or not? | |

| AEO Certificate Number and Validity | |

| Name of Primary Point of Contact | |

| Contact Details & E-mail Address | |

| Relevant Period (Financial Year) | |

| Date of Submission |

(B) Compliance Information

| S. No | Compliance Parameter | Yes | No |

| 1. | Whether there is any case of infringement/Show Cause Notice/Order-in-Original of Customs or GST (erstwhile Central Excise and Service Tax) Laws booked against the AEO status holder and / or the directors / partners / sole proprietor / persons in charge of the applicant’s business for Customs related matter, during the last financial year? If yes, please provide the details of the SCN/OIO issued. | ☐ | ☐ |

| 2. | Whether the Net Worth and Net Current Assets as per the Balance Sheet/IT returns duly audited/filed, are positive during the last financial year? | ☐ | ☐ |

| 3. | Whether any Insolvency, Bankruptcy or Liquidation proceeding has been initiated against the AEO Status holder during the last financial year? | ☐ | ☐ |

| 4. | Whether any new location/site is added during the last financial year? | ☐ | ☐ |

| 5. | Whether the details of such new location/site (at point 4) was communicated to the Zonal/National AEO Programme Manager within 14 days of such addition. If no, please provide the details and site plan of the site added. Note: Please leave this blank in case there is no new addition of location/site during the last financial year. | ☐ | ☐ |

| 6. | Whether the existing system for back-up, recovery, archiving and retrieval of company’s records and information continues to ensure that there is no breach or intrusion or dysfunction noticed in the procedures related to back-up, recovery, archiving and retrieval of the company’s records and information and same is secured against misuse, loss and unauthorized access. | ☐ | ☐ |

| 7. | Whether, if required, the relevant commercial/financial records for the last financial year can be presented to Customs immediately. | ☐ | ☐ |

# Period of Submission of this Annual Self-Declaration is between 1st October and 31st December, each year.

Amendment in AEO Programme: Auto-Renewal of AEO-T1 validity for continuous certification based on continuous compliance monitoring- regarding (Circular No. 18/2021 dated 31.07.2021)