Insurance Regulatory and Development Authority of India (IRDAI) (Assets, Liabilities and Solvency Margin of General Insurance Business) (Amendment) Regulations, 2022.

F No. IRDAI/Reg/7/186/2022.— In exercise of the powers conferred by clauses (y), (z), (za) and (zab) of subsection (2) of Section 114A read with sections 64V and 64VA of the Insurance Act, 1938 (4 of 1938) and section 26 of the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999), the Authority, in consultation with the Insurance Advisory Committee, hereby makes the following regulations to amend Insurance Regulatory and Development Authority of India (Assets, Liabilities and Solvency Margin of General Insurance Business) Regulations, 2016, namely: –

- Short title and commencement

a. These regulations may be called the Insurance Regulatory and Development Authority of India (Assets, Liabilities and Solvency Margin of General Insurance Business) (Amendment) Regulations, 2022.

b. These regulations shall come into force on the date of their publication in the Official Gazette. - The Insurance Regulatory and Development Authority of India (Assets, Liabilities and Solvency Margin of General Insurance Business) Regulations, 2016 shall be amended as follows:

a. In Schedule I, para 1(1)(b) shall be substituted by the following:

“Premiums receivables relating to State/Central Government sponsored schemes, to the extent they are not realized within a period of 365 days”

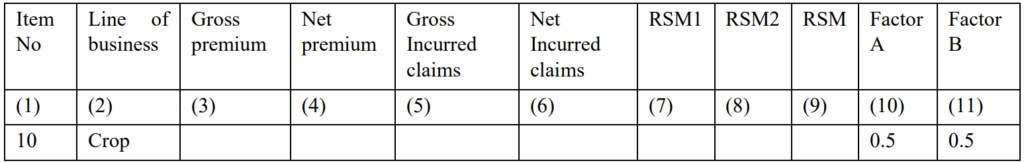

b. In „Table IA: Required Solvency Margin based on Net Premium and Net Incurred Claims‟ of Form IRDAIGI-SM under Schedule III, the following new row shall be inserted between „Item No. 09- Miscellaneous‟ row and the „Total‟ row:

Read More on IRDAI