Investment and Asset allocation

1. Investment:

It is necessary to invest our hard-earned money so that it can generate enough return. Investing is a long-process and we should have efficient plan to invest throughout our life.

There are many reasons to start investment at present and some of them are:

Inflation: in order to maintain purchasing power of money or meet loss of living it is necessary to invest.

Create Wealth: Investment can help us to create wealth or corpus for children’s education, marriage, property purchase etc.

Financial Aspiration: better car, better home, etc.

2. Asset allocation:

It is part of portfolio management. In order to minimize risk in investment, it is necessary to create a diversified portfolio i.e. allocate assets in different investment alternatives such as:- Fixed Income Instruments, Equity, Real Estate, Gold, etc.

Depending upon risk involved, different alternatives provides different return i.e. Higher the risk, higher will be return & Vice- versa.

“Think about a situation- where we invest our entire capital in a particular stock and after few days, heard a news of fraud in a company. If the company dissolve, entire capital will be lost. So, it is better to invest in different stocks rather investing in a particular share”.

Financial regulators & Intermediaries:

- Stock market: As a name suggest, stock market is a platform where, we can buy & sell stock. There are 2 recognized stock exchange in India: NSE and BSE.

- Market participation: Anyone who transact in stock market is called ‘market participants’ such as:

*Retail participants

*Domestic participants

*Asset Management Company

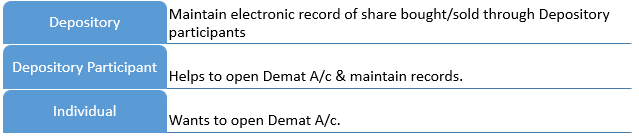

*FII - Depository & Demat A/c: Shares are bought and sold in electronic form. When we buy share, it is our depository account known as Demat A/c. It is electronically maintained by companies in India called as Depository, namely:-

Central Depository Service Limited (CDSL),

National Securities Depository Limited (NSDL). - Depository Participants:

Act as an agent & Depository.

Helps to open & maintain Demat A/c either with CDSL or NSDL.

- Role of bank in market eco-system: Helps to transfer funds from bank A/c of client to client A/c with D.P. & Vice-versa.

- Clearing House: It helps in settlement of transaction i.e. settlement of securities, settlement of fund.

The main purpose of clearing house is to ensure no default by either parties.

Funds are debited from buyer’s A/c and credited to seller’s A/c. similarly, shares are transferred from seller’s Demat A/c to Buyer’s Demat A/c.

Note: National Securities Clearing Corporation Limited (NSCCL) and Indian Clearing Corporation Limited (ICCL) are wholly owned subsidiaries of NSE & BSE respectively. - SEBI and stock market regulations: In India, stock market regulator is called Securities & Exchange Board of India.

SEBI Ensures:

*The stock exchanges i.e. NSE & BSE conduct its business fairly.

*Stock brokers and sub-brokers conduct their business fairly.

*Protect interest of retail investor.

*Participants don’t get involved in unfair practice.

*Overall development of markets etc.

SEBI enforces regulations across all the entities involved in the market.

Primary Market v/s Secondary Market

| Basis | Primary market | Secondary Market |

| Meaning | Offers securities for the first time. | Offers trading of securities already issued. |

| Another Name | New Issue Market (NIM) | Share Market |

| Type of Product | IPO & FPO | Shares, Debentures, etc. |

| Purchase Type | Direct purchase from company through Merchant Banker. | Trading between investors. |

| Intermediator | Underwriter | Brokers |

| Purpose | Raise capital for expansion, Diversification, etc. | Trading, providing liquidity to investor. |

| Price | Company sell shares at fixed price. | Price is determined by demand and supply |

Initial Public Offer (IPO)

- Meaning: IPO is a process where company decides to offer its share to public in exchange of fund.

- Need for IPO: The most popular reason for IPO is to raise fund. However, a company can raise fund through other means as borrowing from bank, domestic institutions, private transaction, etc. A company may require fund for existing project or some new projects or reply existing debt.

- Process of IPO:

*Appoint a merchant banker: in case of large public issue, multiple merchant banker can be appointed.

*Intimate SEBI with a registration statement. The registration statement contains a company’s background and the reasons to go public.

*SEBI reviews the registration statement and takes a call on the worthiness of IPO. SEBI can request for additional details if required.

*The company puts out the Draft Red Herring Prospectus (DRHP), which is a public document.

Once the DRHP is filed, the company embarks on the 2nd set of Steps.

- IPO Promotion: This would involve TV and print adverts to build awareness.

- Price Band: Estimate the price band between which the company would like to go public.

- Book Building: The company has to officially open the window during which the public can subscribe for shares. For example: if the price band is between Rs. 100 and Rs. 120, then the public can choose a price they think is fair enough for the IPO issue. The process of collecting all these price points along with the respective quantities is called the Book Building.

- Closure: After the book building window is closed the price point at which the issue gets listed is decided. This price point is usually that price at which maximum bids have been placed.

- Listing Day: This is the day when company gets listed on the Stock Exchange. The listing price is the price discovered through the book-building process.