Circular for the Portfolio Managers

- Regulation 24(14) of the SEBI (Portfolio Managers) Regulations, 2020 (“PMS Regulations”) mandates a Portfolio Manager to segregate each clients’ funds and portfolio of securities and keep them separately from his own funds and securities and be responsible for safe keeping of clients’ funds and securities.

- Regulation 24 (15) of PMS Regulations mandates the Portfolio Managerstonot hold the securities belonging to the portfolio account, in its own name on behalf of its clients either by virtue of contract with clients or otherwise. Further, circular IMD/DOF I/PMS/Cir-4/2009 dated June 23, 2009 specifies conditions subject to which a Portfolio Manager may keep and maintain the funds of all clients in a separate bank account which inter-alia includes clear segregation of each client’s fund through proper and clear maintenance of back office records.

- In furtherance to the above, it is specified as under:

3.1.Portfolio Managers shall put in place a written down policy (“policy”), in compliance with the PMS Regulations and circulars issued there under, which inter-alia detail the specific activities, role and responsibilities of various teams engaged in fund management, dealing, compliance, risk management, back-office, etc., with regard to management of client funds and securities including the order placement, execution of order, trade allocation amongst clients and other related matters.

3.2.Portfolio Managers shall also put in place a specific policy, in compliance with the PMS Regulations and circulars issued thereunder, which shall inter-alia provide for the following:

a) Specificsituations (not generic) wherein the orders shall be placed for each client individually or pooled from trading account of Portfolio Manager.

b)Scenarios / situations in which deviation from the allotment of securities as intended at the time of placement of order would be permissible, if at all.

c)Scenarios, wherein, the Portfolio Manager is required to place certain margins / collaterals in order to execute certain transactions, details on how such margins / collaterals shall be segregated / placed from amongst various clients, without affecting the interest of any client.

d)Deviations, if any, shall be on account of exigency only and require prior written approval of the Principal Officer and Compliance officer of the Portfolio Manager with a detailed rationale for such deviation.

3.3.The aforesaid policies as mentioned at paras 3.1& 3.2 shall be approved by the Board / equivalent body of the Portfolio Manager. - Portfolio Managers shall ensure that all clients are treated in a fair and equitable manner and ensure compliance with the following:

4.1. Requirements with respect to investments in all instruments:

a)Portfolio Managers shall constitute a dealing team (DT) which shall be responsible for order placement and execution of all orders in accordance with the aforesaid policies of the Portfolio Manager. DT may include the Principal Officer or the person appointed in terms of Regulation 7(2) (e) of PMS Regulations.

b)Portfolio Managers shall ensure that DTis suitably staffed and comply with the following:

i.All conversations of DT shall be only through the dedicated recorded telephone lines or through emails from authorized email ids.

ii.Mobile phones or any other communication devices other than the recorded telephone lines shall not be allowed inside the dealing room.

iii.Access to internet facilities on computers and other devices inside the dealing room shall be restricted and shall only be used for activities related to trade execution.

iv.Entry/access to the dealing room shall be restricted to authorized employees as defined in the aforementioned policies of the Portfolio Manager.

v.There shall be no sharing of information through any mode, except for trade execution under the approved policies of the Portfolio Manager.

4.2. For equity, equity-related instruments and Mutual Funds units

a)Portfolio Managers with assets under management of INR 1000 crores or more under discretionary and non-discretionary services, shall have in place an automated system with minimal manual intervention for ensuring effective funds and securities management including order management and allocation of securities to each client.

b)The aforesaid system shall inter-alia clearly capture details with respect to pre-order placement allocation as well as final allocation of trades to clients along with instances of deviation, if any, as mentioned at para 3.2 (d)above. - Portfolio Managers shall maintain audit trail of all activities related to management of funds and securities of clients including order placement, trade execution and allocation. Further, there shall be time stamping with respect to order placement, order execution and trade allocation.

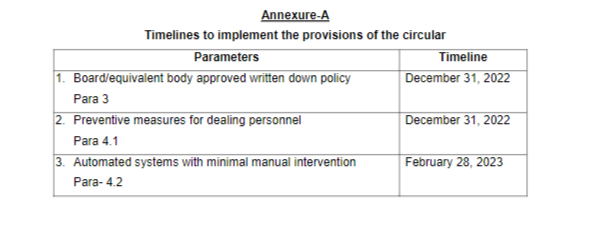

- Implementation Schedule:

6.1.Based on APMI’s (Association of Portfolio Managers in India) deliberations with the stakeholders, it has been decided that the provisions of this Circular shall be applicable with effect from April 01, 2023.

6.2.APMI shall endeavour to ensure that all Portfolio Managersadhereto the activity wise timelines given at Annexure –A so as to ensure compliance with para 6.1 above.

6.3.Portfolio Managers and APMI shall take necessary steps for implementing the circular, including putting required processes and systems in place to ensure compliance with the provisions of this circular.

6.4.APMI shall furnish progress in implementation of provisions of this circular to SEBI on a bi-monthly basis, starting from December 01, 2022. - This circular is issued in exercise of powers conferred under Section 11(1) of the Securities and Exchange Board of India Act, 1992 read with Regulation 43 of the SEBI (Portfolio Managers) Regulations, 2020, to protect the interests of investors in securities market and to promote the development of, and to regulate the securities market.

Read More on SEBI