Clarification regarding Form No 10AC issued till the date of this Circular – reg.

Circular No. 11 of 2022

Finance Act, 2022 has inserted sub-section (4) in section 12AB of the Income-tax Act, 1961 (the Act) allowing the Principal Commissioner or Commissioner of Income-tax to examine if there is any “specified violation” by the trust or institution registered or provisionally registered under the relevant clauses of sub-section (1) of section 12AB or subsection (1) of section 12AA. Subsequent to examination by the Principal Commissioner or Commissioner of Income-tax, an order is required to be passed for either cancellation of the registration or refusal to cancel the registration. Similar provisions have also been introduced in clause (23C) of section 10 of the Act by substituting the fifteenth proviso of the said clause

with respect to fund or institution trust or institution or any university or other educational institution or any hospital or other medical institution referred under sub-clauses (iv), (v), (vi), (via) of this clause and which have been approved or provisionally approved under the second proviso to the said clause. These amendments are effective from 1st April, 2022. In addition to the specified violations referred above, the power of cancellation has also been granted under sub-rule (5) of rule 17A and sub-rule (5) of rule 2C of the Income-tax Rules, 1962 ( the Rules) to the Principal Commissioner or Commissioner authorised by the Board. This Circular only relates to cancellation of registration/approval or provisional registration/approval in the case of “specified violation”.

- The definition of “specified violation” for the purposes of fifteenth proviso to clause (23C) of section 10 and section 12AB of the Act has been provided in the respective clause and section. The said definition, inter-alia, includes instances where any activity of the fundor trust or institution is not being carried out in accordance with all or any of the conditions subject to which it was approved/ provisionally approved or registered/provisionally registered.

- It may be noted that as per the new procedure for approval/registration of charitable entities, which was notified vide Notification No 19/2021 dated 26.03.2021, the entities seeking re-registration/ approval or provisional registration/ approval (fresh) are required tofile an application in Form 10A. Further, the order granting registration or provisional registration or approval or provisional approval is made in Form 10AC subject to the fulfilment of certain conditions.

- In view of the amendments made vide Finance Act, 2022, the conditions subject to which the registration/approval or provisional registration/ provisional approval was granted to trusts and institutions need to be revised to align the same with the amendments made by Finance Act, 2022.

- In view of the above, it is hereby clarified that,-

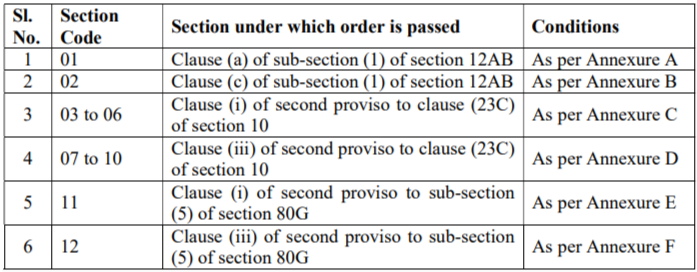

- the conditions contained in Form No. 10AC, issued between 01.04.2021 till the date of issuance of this Circular, shall be read as if the said conditions had been substituted with the conditions as provided in the Table 1 with effect from 1st April, 2022;

Table 1

- where due to technical glitches, Form No. 10AC has been issued during FY 2021-2022 with the heading “Order for provisional registration” or “ Order for provisional approval” instead of “Order for registration” or “ Order for approval”, then all such Form No. 10AC shall be considered as an “Order for registration or approval” and, in such cases where Form No. 10AC has been issued, –

(a) under section code 01 (applications seeking re-registration),-

(i) in the heading and in rows 6, 7, 9 and 10 the words ,“ provisional registration” shall be read as “registration”;

(ii) in row 8 the word “ provisionally registered” shall be read as “registered”;

(b) under section codes 03, 04, 05, 06 or 11 (applications seeking re-approval),-

(i) in the heading and in rows 6, 7, 9 and 10 the words ,“ provisional approval” shall be read as “approval”;

(ii) in row 8 the word “ provisionally approved” shall be read as “approved”; - row no 5 of Form No. 10AC ( issued for all section codes) shall be read as “Unique Registration Number” instead of “Provisional Approval/ Approval Number” or “ Provisional Registration/ Registration Number”, as the case maybe.

Read More on Income-tax, CBDT