G.S.R. 623(E).—Whereas, in the matter of “Flat Products of Stainless Steel” (hereinafter referred to as the subject goods) falling under headings 7219 and 7220 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), (hereinafter referred to as the Customs Tariff Act), originating in or exported from Indonesia (hereinafter referred to as the subject country), and imported into India, the Designated Authority in its preliminary findings, published in the Gazette of India, Extraordinary, Part I, Section 1, vide notification No. 6/16/2019-DGTR, dated the 7th August, 2020 has come to the conclusion that-

(i) the subject goods have been exported to India from subject country at subsidised prices;

(ii) the domestic industry has suffered material injury due to subsidisation of the subject goods;

(iii) the material injury has been caused by the subsidised imports of the subject goods originating in or exported from the subject country; and has recommended the imposition of provisional countervailing duty on imports of the subject goods originating in, or exported, from the subject country.

Now, therefore, in exercise of the powers conferred by sub-section (2) of section 9 of the Customs Tariff Act, read with rules 15 and 22 of the Customs Tariff (Identification, Assessment and Collection of Countervailing Duty on Subsidized Articles and for Determination of Injury) Rules, 1995, the Central

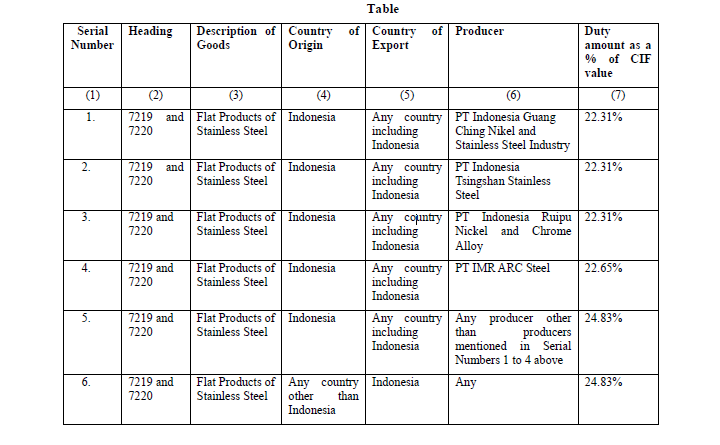

Government, after considering the aforesaid preliminary findings of the designated authority, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under heading of the First Schedule to the Customs Tariff Act as specified in the corresponding entry in column (2), originating in the countries as specified in the corresponding entry in column (4), exported from the countries as specified in the corresponding entry in column (5), produced by the

producers as specified in the corresponding entry in column (6), and imported into India, a provisional countervailing duty calculated at the rate mentioned in column (7) of the said Table, namely:-

Provided that provisional countervailing duty shall not be payable on imports of the following goods, namely:-

(a) Blade steel, or commercially known as razor blade grade steel used in the production of razor;

(b) Coin blank, falling under tariff item 7326 90 99 of the Custom Tariff Act, used in the production of monetary coins;

(c) Flat rolled products of stainless steel of thickness greater than 80 millimeters;

(d) Flat rolled products of stainless steel of width more than 1650 millimeters for use in the same form without slitting into products having width lower than 1650 millimeters after importation.

Provided further that the importer shall follow the procedure set out in the Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017 with respect to goods mentioned in clause (d) of the first proviso.

Explanation: The exclusion from payment of provisional countervailing duty in respect of goods at clause (d) of the first proviso shall not be applicable in those cases where such goods are slit into products having

width lower than 1650 millimeters after importation thereof.

- The provisional countervailing duty imposed under this notification shall be levied for a period of four months (unless revoked, amended or superseded earlier) from the date of publication of this notification in

the Official Gazette, and shall be payable in Indian currency.

Explanation.- For the purposes of this notification:-

(1) rate of exchange applicable for the purposes of calculation of such provisional countervailing duty shall be the rate, which is specified in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to time, in exercise of the

powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the said Customs Act;

(2) “CIF value” means the assessable value as determined under section 14 of the Customs Act, 1962 (52 of 1962).

Download: http://egazette.nic.in/WriteReadData/2020/222328.pdf