Incentive scheme for promotion of RuPay Debit Cards and low-value BHIM-UPI transactions (P2M)

No. 24(1)/2020-DPD-Part(2).—1. The Government is taking various initiatives to promote digital payments. Over past few years, digital payment transactions have witnessed tremendous growth across the country with the number of transactions growing from 2,071 crore in FY2017-18 to 8,840 crore in FY2021-22.

- Although there has been an unprecedented growth in digital payments over the past few years, there is potential for further growth. It is, therefore, important to boost the adoption of digital payments, targeting untapped markets/ segments/ sectors.

- In compliance with the Budget announcement (FY2022-23) and to give further boost to digital transactions in the country, it has been decided by the Government to incentivise the acquiring Banks by way of paying a percentage of value of RuPay Debit Cards transactions and low-value BHIM-UPI transactions (upto ₹ 2,000) (Person-to-Merchant- P2M), for financial year 2022-23,with effect from April 01, 2022.

- This incentive scheme will promote digital payments by incentivising banks to build a robust digital payments ecosystem and to promote RuPay Debit Cards and BHIM-UPI as low-cost digital payments mode across all sectors and segments of population. In line with the Budget announcement, the scheme will also promote UPI Lite and UPI 123PAY as economical and user-friendly digital payments solutions.

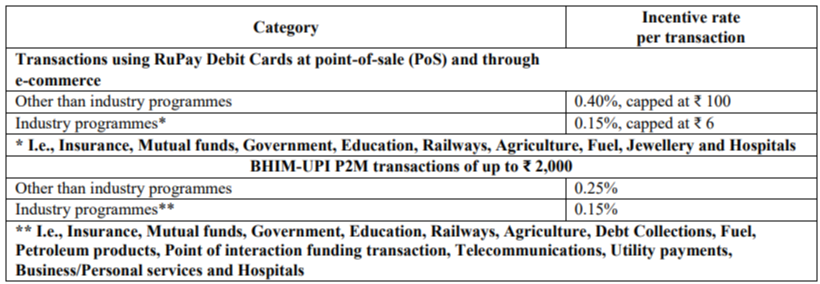

- The scheme will provide financial incentive to acquiring banks for promoting point-of-sale (PoS) and e-commerce transactions using RuPay Debit Cards and person-to-merchant (P2M) transactions of low value (i.e., up to ₹ 2,000) on the BHIM-UPI platform, as per the incentive rates and other details given below:

(a) The duration of the scheme is one yeari.e. FY2022-23, with effect from 1.4.2022.

(b) The Ministry of Electronics and Information Technology (MeitY), in consultation with National Payments Corporation of India (NPCI), may review from time to time the utilisation of funds under the scheme and, accordingly, add or omit merchant categories included in industry programmes.

(c) The financial outlay for the scheme shall be restricted to ₹ 2,600 crore. To secure this, MeitY will, if required, review the merchant categories included in industry programmes. The allocation of ₹ 2,600 crore will be fungible between RuPay Debit Cards and BHIM-UPI.

(d) Reimbursement of claims of banks will be done on a quarterly basis, to the following extent:

(i) For the first, second and third quarters of the scheme, 90% of the admitted claim amount for the bank;

(ii) For the fourth quarter of the scheme, 80% of the admitted claim amount for the bank:

Provided that the reimbursement of the remaining percentage of the admitted claim amount for each quarter will be contingent upon fulfilment of the conditions in clause (e).

(e) For being eligible to receive the remaining percentage of the admitted claim amount under the proviso to clause (d), banks will be required to fulfil the following conditions:

(i) In order to be eligible for reimbursement of 10% of the remaining admitted claim, the bank will show at least 10% YoY growth in the number of RuPay Debit Cards transactions (PoS and e-commerce transactions) and 70% YoY growth in the number of BHIM-UPI P2M transactions at the end of the last quarter of the scheme.

(ii) In order to be eligible for reimbursement of 10% of the remaining admitted claim for the fourth quarter, the bank will enable the features of UPI Lite and UPI 123PAY on the existing BHIM-UPI platform and will show at least 2% of BHIM-UPI P2M transactions on UPI Lite during the last quarter of the scheme.

(f) MeitY, in consultation with NPCI, will issue operational guidelines for implementation of the scheme.

(g) The incentive will be shared by the acquiring banks with other payment system participants and the payment system operator, in the proportion and manner decided by NPCI in consultation with the participating banks.

(h) The Scheme is applicable to the Banks having operations in India and transactions done in India

Read More on Finance