National Financial Reporting Authority (NFRA) was constituted on 01st October,2018 by the Government of India under section 132(1) of the Companies Act, 2013.

As per rule 3 of the NFRA rules,2018,

(1) The Authority shall have power to;

Monitor and enforce compliance with accounting standards and auditing standards,

Oversee the quality of service under sub-section (2) of section 132 or Undertake investigation under sub-section (4) of such section of the auditors of the following class of companies and bodies corporate, namely:-

(a) Every Listed Companies whose securities are listed on any stock exchange in India or outside India;

(b) Unlisted public companies

having paid-up capital (Equity + Preference) of not less than Rs. 500 crores or

Having annual turnover of not less than Rs. 1,000 crores

or

Having, in aggregate, outstanding loans, debentures and deposits of not less than Rs. 500 crores as on the 31st March of immediately preceding financial year;

(c) Companies governed by their own act (i.e. Insurance companies, banking companies, companies engaged in the generation or supply of electricity, other companies governed by any special Act for the time being in force or bodies corporate incorporated by an Act in accordance with clauses (b), (c), (d), (e) and (f) of sub-section (4) of section 1^ of the Companies Act 2013)

^Section- 1(4) talks about the entities on which the provisions of this act does not apply.

(d) Any body corporate or company or person, or any class of bodies corporate or companies or persons, on a reference made to the Authority by the Central Government in public interest; and

(e) A body corporate incorporated or registered outside India, which is a subsidiary or associate company of any company or body corporate incorporated or registered in India as referred to in clauses (a) to (d), if the income or net worth of such subsidiary or associate company exceeds 20% of the consolidated income or consolidated net worth of such company or the body corporate, as the case may be, referred to in clauses (a) to (d).

Note: The companies which are exempted from the applicability of the NFRA Rules are:

1) Private Companies (unless referred by Central Government to the Authority in public interest); and

2) Unlisted public companies with paid-up capital or turnover or aggregate of loans, debentures and deposits below the limit.

Rule (3)(2) – Every existing Body Corporate other than a company governed by the NFRA Rules, shall, within 30 days from the date of commencement of the Rules, inform the Authority in Form NFRA-1 about the particulars of the auditors as on the date of commencement of the NFRA Rules.

Rule (3)(3) – Every Body Corporate other than Indian Companies shall within 15 days of appointment of an auditor, inform the Authority in Form NFRA-1, about the particulars of the auditors appointed by the body corporate under Section 139(1) of the Companies Act, 2013

Provided that a body corporate governed under clause (e) of sub-rule (1) shall provide details of appointment of its auditor in Form NFRA-1.

Rule (3)(4) – (Lock-in Period to follow NFRA rules)

A company or a body corporate other than a company governed under this rule shall continue to be governed by the Authority for a period of 3 years after it ceases to be listed or its paid-up capital or turnover or aggregate of loans, debentures and deposits falls below the limit stated therein.

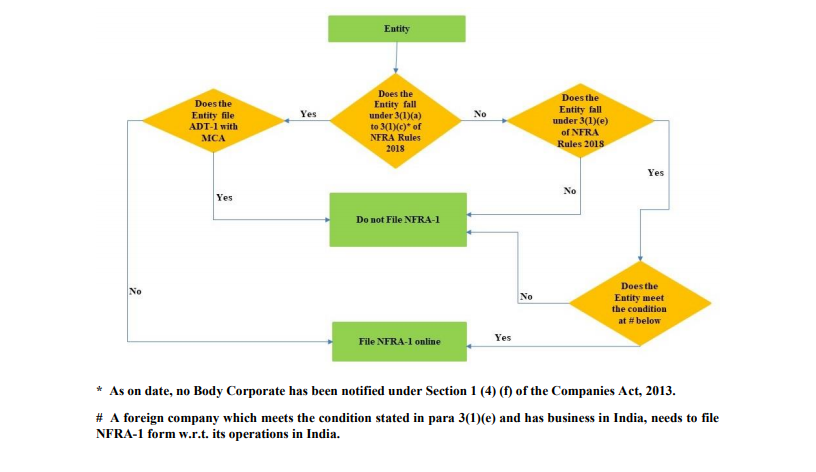

Refer the chart given below to understand who needs to file NFRA-1

As per National Financial Reporting Authority Amendment Rules 2019, every auditor referred in Rule 3(2) and 3(3) of the NFRA Rules as above, has to file Form NFRA-2 with the Authority on or before 30th November of every financial year.

Functions and Duties:

- Recommend accounting and auditing policies and standards to be adopted by companies for approval by the Central Government.

- Monitor and enforce compliance with accounting standards and auditing standards.

- Oversee the quality of service of the professions associated with ensuring compliance with such standards and suggest measures for improvement in the quality of service.

- Perform such other functions and duties as may be necessary or incidental to the aforesaid functions and duties.

For the purpose of recommending accounting standards or auditing standards for approval by the Central Government, the Authority:

(a) shall receive recommendations from the Institute of Chartered Accountants of India on proposals for new accounting standards or auditing standards or for amendments to existing accounting standards or auditing standards,

(b) may seek additional information from the Institute of Chartered Accountants of India on the recommendations received under clause (a), if required.

The Authority shall consider the recommendations and additional information in such manner as it deems fit before making recommendations to the Central Government.

- For the purpose of monitoring and enforcing compliance with accounting standards under the Act by a company or a body corporate governed under rule 3,

The Authority may review the financial statements of such company or body corporate, as the case may be, and if so required, direct such company or body corporate or its auditor by a written notice, to provide further information or explanation or any relevant documents relating to such company or body corporate, within such reasonable time as may be specified in the notice. - The Authority may require the personal presence of the officers of the company or body corporate and its auditor for seeking additional information or explanation in connection with the review of the financial statements of such company or body corporate.

- The Authority shall publish its findings relating to non-compliances on its website and in such other manner as it considers fit, unless it has reasons not to do so in the public interest and it records the reasons in writing.

- Where the Authority finds or has reason to believe that any accounting standard has or may have been violated, it may decide on the further course of investigation or enforcement action through its concerned Division.

For the purpose of monitoring and enforcing compliance with auditing standards under the Act by a company or a body corporate governed under rule 3, the Authority may:

*Review working papers (including audit plan and other audit documents) and communications related to the audit

*Evaluate the sufficiency of the quality control system of the auditor and the manner of documentation of the system by the auditor, and;

*Perform such other testing of the audit, supervisory, and quality control procedures of the auditor as may be considered necessary or appropriate.