Circumstance, where we need to file CA certificate with form GSTR-10 (Final Return), is explained below:

About Final Return:

Every registered person who is required to furnish a return

under sub-section(1) of section 39 and whose registration has been cancelled shall furnish a final return within three months of the date of cancellation or date of order of cancellation, whichever is later.

Every registered person required to file a final return shall furnish such return electronically in FORM GSTR-10 through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

About CA Certificate:

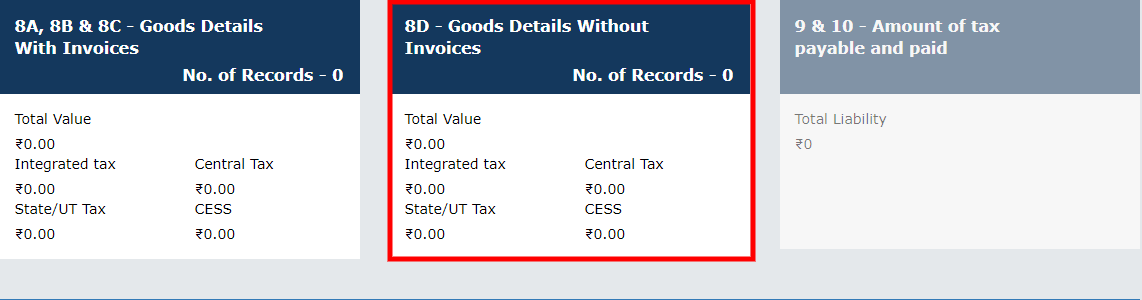

- Certificate from Chartered Accountant or Cost Accountant needs to be uploaded if details are uploaded in table 8D (Goods Details without Invoices).

- Provide the mandatory details as required.

- Only one file can be uploaded in PDF/JPEG format.

- After uploading the certificate, click on ‘SAVE CA DETAILS’.

Note: The details relating to CA certificate can be amended before filing.

Click here to File GST Return