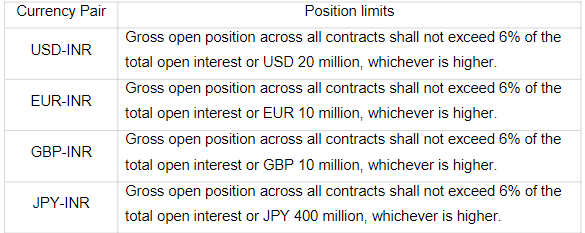

Position Limits for Currency Derivatives Contracts

- SEBI vide circular CIR/MRD/DP/20/2014 dated June 20, 2014 inter aliaprescribed the position limits in permitted currency pairs. Based on feedback received from Stock Exchanges/ Clearing Corporations and upon a review of the same, it has been decided to revise the client level position limits, per stock exchange,as follows:

- The revised position limits shall also apply to Non Resident Indians (NRIs) and Category II FPIs that are individuals, family offices, and corporates.The circular(s) SEBI/HO/MRD/DP/CIR/P/2017/63dated June 28, 2017 and CIR/MRD/DP/20/2014 dated June 20, 2014 read with SEBI circular IMD/FPI&C/CIR/P/2019/124dated November 05, 2019 shall stand modified to the extent mentioned above.

- The position limits for Category I FPIs and Category II FPIs (other than individuals, family offices, and corporates) shall continue to remain the same as specified vide SEBI circular CIR/MRD/DP/20/2014 dated June 20, 2014 read with SEBI circular IMD/FPI&C/CIR/P/2019/124 dated November 05, 2019. All other conditions as specified vide earlier SEBI circulars shall also remain unchanged.

- Stock Exchanges/ Clearing Corporations may specify additional safeguards/ conditions, as deemed fit, to manage risk and to ensure orderly trading.

- The provisions of this circular shall come into force with immediate effect.

- This circular is being issued in exercise of powers conferred under Section 11(1) of the Securities and Exchange Board of India Act, 1992, to protect the interests of investors in securitiesand to promote the development of, and to regulate, the securities market.

Read More on SEBI