Relaxation in timelines for compliance with regulatory requirements

- In view of the situation arising due to COVID-19 pandemic, lockdown imposed by the Government and representations received from Stock Exchanges, SEBI had earlier provided relaxations in timelines for compliance with various regulatory requirements by the trading members / clearing members / depository participants, vide circular nos. SEBI/HO/MIRSD/DOP/CIR/P/2020/61 dated April 16, 2020, SEBI/HO/MIRSD/DOP/CIR/P/2020/62 dated April 16, 2020, SEBI/HO/MIRSD/DOP/CIR/P/2020/68 dated April 21, 2020 and SEBI/HO/MIRSD/DOP/CIR/P/2020/72 dated April 24, 2020.

- Later, vide circular nos. SEBI/HO/MIRSD/DOP/CIR/P/2020/82 dated May 15, 2020, SEBI/HO/MIRSD/DOP/CIR/P/2020/101 dated June 19, 2020, SEBI/HO/MIRSD/DOP/CIR/P/2020/112 dated June 30, 2020, SEBI/HO/MIRSD/DOP/CIR/P/2020/141 dated July 29, 2020, SEBI/HO/MIRSD/DOP/CIR/P/2020/142 dated July 29, 2020, SEBI/HO/MIRSD/DOP/CIR/P/2020/191 dated October 01, 2020 and SEBI/HO/MIRSD/DOP/CIR/P/2020/235 dated December 01, 2020, timelines / period of exclusion were further extended for certain compliance requirements.

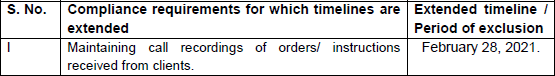

- In view of the prevailing situation due to Covid-19 pandemic and representation received from the Stock Exchanges, it has been decided to extend the timelines for compliance with the following regulatory requirements by the trading members / clearing members, as under:

- With regard to KYC application form and supporting documents of the clients to be uploaded on system of KRA by the members, for which relaxation has been provided till December 31, 2020 vide circular no. SEBI/HO/MIRSD/DOP/CIR/P/2020/191 dated October 01, 2020, Stock Exchanges / Clearing Corporation shall direct their members to clear the backlog, if any, by January 31, 2021.

- Stock Exchanges / Clearing Corporations are directed to bring the provisions of this circular to the notice of their members and also disseminate the same on their websites.

- This circular is issued in exercise of powers conferred under Section 11(1) of the Securities and Exchange Board of India Act, 1992, to protect the interests of investors in securities and to promote the development of, and to regulate the securities markets.