Revision in Daily Price Limits (DPL) for Commodity Futures Contracts

- The Daily Price Limits in commodity futures market serve an important function of defining the maximum range within which the price of a commodity futures contract can move in one trading session. The defined daily price limits protect investors from sudden and extreme price movements and provides cooling-off period to re-assess the information and fundamentals impacting the price of the commodity futures contract. Thus, DPLs can neither be too narrow nor too wide as it will restrict fair price discovery.

- SEBI vide Circular no. CIR/CDMRD/DMP/2/2016 dated January 15, 2016 and Circular no. SEBI/HO/CDMRD/DMP/CIR/P/2016/83 dated September 07, 2016 had issued norms for Daily Price Limits (DPL) for agricultural and non-agricultural commodity derivatives. Continuing with SEBI’s endeavor to develop the commodity derivatives market and in consultation with the stock exchanges, the norms for DPL for commodity futures contracts (excluding Index Futures and options) are being revised. The revised norms are given below.

- Base price for DPL: The base price for fixing the DPL slabs shall be the previous day’s closing price of the underlying contract on the respective stock exchange.

- Order Acceptance: The stock exchanges shall ensure that their system should only accept those orders which are within the relevant prescribed slab at any point of time.

- Breach of slab: A breach of the slab shall be considered when trading in a contract is executed at the upper or lower band of the prescribed slab.

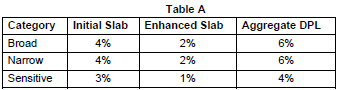

- DPL for Commodity futures contracts which are based on agricultural and agri-processed goods

6.1. SEBI vide circular no. SEBI/HO/CDMRD/DMP/CIR/P/2017/84 dated July 25, 2017 prescribed a framework to categorize agricultural commodity derivative contracts into “broad”, “narrow” and “sensitive” categories. Henceforth, the DPL shall be linked to the said classification of agricultural and agri-processed goods.

6.2. Accordingly, the DPL for commodity futures contracts based on agricultural and agri-processed goods has been revised as under:

6.3. Once the initial slab limit is breached in any contract, then, after a cooling-off period of 15 minutes, this limit shall be increased further by enhanced slab, only in that contract.

6.4. During the cooling-off period of 15 minutes, the trading shall be permitted, within the initial slab limit.

6.5. After the DPL is enhanced, trading shall be permitted throughout the day within the enhanced Aggregate DPL.

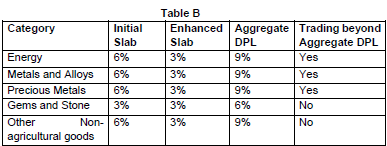

- DPL for Commodity futures contracts which are based on non-agricultural goods

7.1. Following slabs shall be applied for DPL on futures contracts based on non-agricultural goods:

7.2. Once the initial slab limit is breached in any contract, the DPL for that contract shall be relaxed further by the ‘Enhanced Slab’ after the cooling off period of 15 minutes in the trading.

7.3. During the cooling off period trading shall continue to be permitted within the previous slab of DPL.

7.4. In case the price movement in the international markets is more than the aggregate DPL, the same may be further relaxed in stages of 3% by the Exchange with cooling off period of 15 minutes. For such instances, the Stock Exchanges shall immediately inform the Integrated Surveillance Department (ISD) of SEBI about any such relaxation of DPLs beyond Aggregate DPL, along with all the relevant details and justification for the same.

7.5. Only in the event of exceptional circumstances, where there is extreme price movement, beyond the initial slab of the DPL, in the international markets, during trading hours or after the closure of trading on domestic exchanges, the stock exchanges can relax the DPL directly by the required level, by giving appropriate notice to the market and also inform the Integrated Surveillance Department (ISD) of SEBI immediately, as per para 7.4. above.

- DPL on First Trading Day of the Contract

8.1. In order to prescribe DPL slabs for the first trading day (launch day) of each contract, Stock Exchange shall determine base price as under:

8.1.1 Volume Weighted Average Price (VWAP) of the first half an hour, subject to minimum of ten trades

8.1.2 If sufficient number of trades are not executed during the first half an hour, then the VWAP of first hour trade subject to minimum of ten trades shall be considered.

8.1.3 If sufficient number of trades are not executed even during the first hour of the day, then VWAP of the first ten trades during the day shall be considered.

8.2. The base price arrived as per Para 8.1.1 or Para 8.1.2 or Para 8.1.3 above, as the case may be, shall be calculated by the Exchange and shall be used to determine DPL for the remaining part of the day.

8.3. However, in case there is no trade during the day or there are less than ten trades during the day, the exchange shall adopt an appropriate methodology for determining the base price and disclose the same on their website for dissemination to the stakeholders. DPL on the next trading day will be applicable on such base price.

- Calculation of closing price or daily settlement price (DSP)

9.1. The Stock Exchange / Clearing Corporation shall determine the closing price or daily settlement price in the following order:

9.1.1 VWAP of all trades done during last half an hour of the trading day;

9.1.2 If the number of trades during last half an hour is less than 10, then DSP shall be based on the VWAP of the last 10 trades executed during the day;

9.1.3 If the number of trades done during the day is less than 10 or no trade has been executed in a contract on a day, the stock exchange/ clearing corporation shall adopt an appropriate methodology for determining daily closing price/ settlement price and disclose the same on their website for dissemination to the stakeholders.

9.2. The Stock Exchange / Clearing Corporation can increase the number of minimum trades based on the liquidity criteria set by the Exchange / Clearing Corporation. Approval shall be taken from their Risk Management Committee on liquidity criteria and disclosed by them on their website. - For any commodity futures contracts, the stock exchange at its discretion, may prescribe DPL narrower than the slabs prescribed above based upon reasons including analysis of price movements, findings pertaining to surveillance, etc.

- The Stock Exchanges and Clearing Corporations, shall make necessary changes in their systems, as may be required.

- The provisions of this Circular shall come into effect from April 1,2021.

- SEBI Circular No SEBI/HO/CDMRD/DMP/CIR/P/2016/83 dated September 07, 2016 and Clause 1(a) of SEBI Circular no. CIR/CDMRD/DMP/2/2016 dated January 15, 2016 shall stand repealed from the date of implementation of this Circular.

- This Circular is issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992, to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

- The Stock Exchanges are advised to:

15.1. to make necessary amendments to the relevant bye-laws, rules and regulations;

15.2. bring the provisions of this circular to the notice of the stock brokers of the Exchange and also to disseminate the same on their website; and

15.3. communicate to SEBI, the status of the implementation of the provisions of this circular.