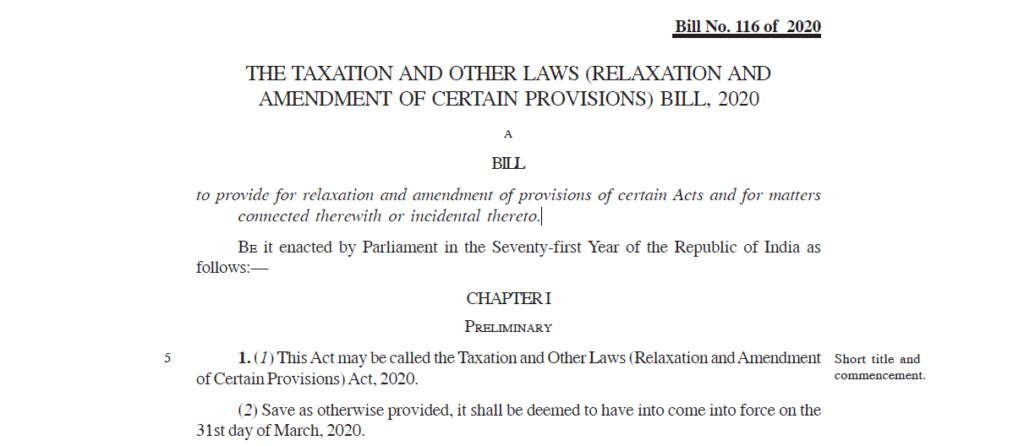

Bill No. 116 of 2020

(1) This Act may be called the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020.

(2) Save as otherwise provided, it shall be deemed to have into come into force on the 31st day of March, 2020.

- (1) In this Act, unless the context otherwise requires,—

(a) “specified Act” means—

(i) the Wealth-tax Act, 1957;

(ii) the Income-tax Act, 1961;

(iii) the Prohibition of Benami Property Transactions Act, 1988;

(iv) Chapter VII of the Finance (No. 2) Act, 2004;

(v) Chapter VII of the Finance Act, 2013;

(vi) the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015;

(vii) Chapter VIII of the Finance Act, 2016; or

(viii) the Direct Tax Vivad se Vishwas Act, 2020;

(b) “notification” means the notification published in the Official Gazette.

(2) The words and expressions used herein and not defined, but defined in the specified Act, the Central Excise Act,1944, the Customs Act, 1962, the Customs Tariff Act,1975 or the Finance Act,1994, as the case may be, shall have the meaning respectively assigned to them in that Act.