₹1,40,885 crore gross GST Revenue collection for May 2022

₹1,40,885 crore gross GST Revenue collection for May 2022; increase of 44% year-on-year

GST collection crosses ₹1.40 lakh crore mark 4th time since inception of GST; 3rd month at a stretch since March 2022

Posted On: 01 JUN 2022 1:28PM by PIB Delhi

The gross GST revenue collected in the month of May 2022 is ₹1,40,885 crore of which CGST is ₹25,036 crore, SGST is ₹32,001 crore, IGST is ₹73,345 crore (including ₹ 37469 crore collected on import of goods) and cess is ₹10,502 crore (including ₹931 crore collected on import of goods).

The government has settled ₹27,924 crore to CGST and ₹23,123 crore to SGST from IGST. The total revenue of Centre and the States in the month of May 2022 after regular settlement is ₹52,960 crore for CGST and ₹55,124 crore for the SGST. In addition, Centre has also released GST compensation of ₹86912 crores to States and UTs on 31.05.2022.

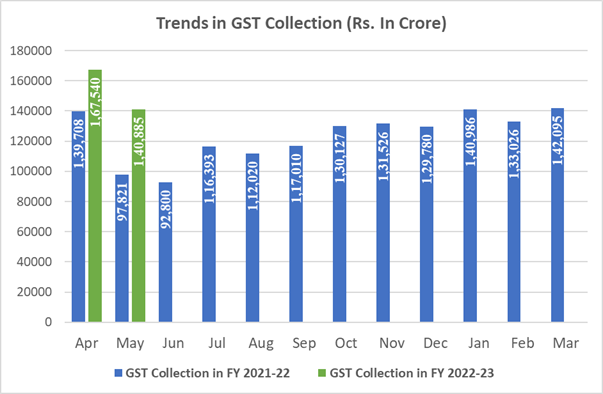

The revenues for the month of May 2022 are 44% higher than the GST revenues in the same month last year of ₹97,821 crore. During the month, revenues from import of goods was 43% higher and the revenues from domestic transaction (including import of services) are 44% higher than the revenues from these sources during the same month last year.

This is only the fourth time the monthly GST collection crossed ₹1.40 lakh crore mark since inception of GST and third month at a stretch since March 2022. The collection in the month of May, which pertains to the returns for April, the first month of the financial year, has always been lesser than that in April, which pertains to the returns for March, the closing of the financial year. However, it is encouraging to see that even in the month of May 2022, the gross GST revenues have crossed the ₹1.40 lakh crore mark. Total number of e-way bills generated in the month of April 2022 was 7.4 crore, which is 4% lesser than 7.7 crore e-way bills generated in the month of March 2022.

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of May 2022 as compared to May 2021.

State-wise growth of GST Revenues during May 2022[1]

| State | May-21 | May-22 | Growth |

| Jammu and Kashmir | 232 | 372 | 60% |

| Himachal Pradesh | 540 | 741 | 37% |

| Punjab | 1,266 | 1,833 | 45% |

| Chandigarh | 130 | 167 | 29% |

| Uttarakhand | 893 | 1,309 | 46% |

| Haryana | 4,663 | 6,663 | 43% |

| Delhi | 2,771 | 4,113 | 48% |

| Rajasthan | 2,464 | 3,789 | 54% |

| Uttar Pradesh | 4,710 | 6,670 | 42% |

| Bihar | 849 | 1,178 | 39% |

| Sikkim | 250 | 279 | 12% |

| Arunachal Pradesh | 36 | 82 | 124% |

| Nagaland | 29 | 49 | 67% |

| Manipur | 22 | 47 | 120% |

| Mizoram | 15 | 25 | 70% |

| Tripura | 39 | 65 | 67% |

| Meghalaya | 124 | 174 | 40% |

| Assam | 770 | 1,062 | 38% |

| West Bengal | 3,590 | 4,896 | 36% |

| Jharkhand | 2,013 | 2,468 | 23% |

| Odisha | 3,197 | 3,956 | 24% |

| Chattisgarh | 2,026 | 2,627 | 30% |

| Madhya Pradesh | 1,928 | 2,746 | 42% |

| Gujarat | 6,382 | 9,321 | 46% |

| Daman and Diu | 0 | 0 | 153% |

| Dadra and Nagar Haveli | 228 | 300 | 31% |

| Maharashtra | 13,565 | 20,313 | 50% |

| Karnataka | 5,754 | 9,232 | 60% |

| Goa | 229 | 461 | 101% |

| Lakshadweep | 0 | 1 | 148% |

| Kerala | 1,147 | 2,064 | 80% |

| Tamil Nadu | 5,592 | 7,910 | 41% |

| Puducherry | 123 | 181 | 47% |

| Andaman and Nicobar Islands | 48 | 24 | -50% |

| Telangana | 2,984 | 3,982 | 33% |

| Andhra Pradesh | 2,074 | 3,047 | 47% |

| Ladakh | 5 | 12 | 134% |

| Other Territory | 121 | 185 | 52% |

| Center Jurisdiction | 141 | 140 | 0% |

| Grand Total | 70,951 | 1,02,485 | 44% |

[1]Does not include GST on import of goods

Read More on GST