Advance Tax collections for F.Y. 2020-21 shows a growth

Advance Tax collections for F.Y. 2020-21 stand at Rs. 4.95 lakh crore which shows a growth of approximately 6.7%

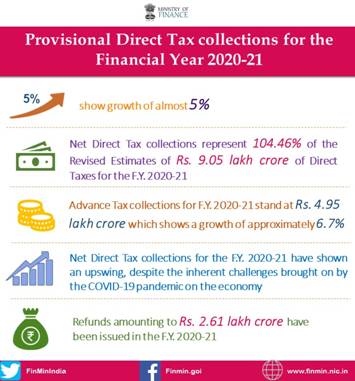

Net Direct Tax collections for the F.Y. 2020-21 have shown an upswing, despite the inherent challenges brought on by the COVID-19 pandemic on the economy

Refunds amounting to Rs. 2.61 lakh crore have been issued in the F.Y. 2020-21

Posted On: 09 APR 2021 12:22PM by PIB Delhi

The provisional figures of Direct Tax collections for the Financial Year 2020-21 show that net collections are at Rs. 9.45 lakh crore. The net Direct Tax collections include Corporation Tax (CIT) at Rs. 4.57 lakh crore and Personal Income Tax(PIT) including Security Transaction Tax(STT) at Rs. 4.88 lakh crore. The net Direct Tax collections represent 104.46% of the Revised Estimates of Rs. 9.05 lakh crore of Direct Taxes for the F.Y. 2020-21.

The Gross collection of Direct Taxes(before adjusting for refunds) for the F.Y. 2020-21 stands at Rs. 12.06 lakh crore. This includes Corporation Tax(CIT) at Rs. 6.31 lakh crore and Personal Income Tax (PIT) including Security Transaction Tax(STT) at Rs. 5.75 lakh crore; Advance Tax of Rs. 4.95 lakh crore; Tax Deducted at Source (including Central TDS) of Rs. 5.45 lakh crore; Self-Assessment Tax of Rs. 1.07 lakh crore; Regular Assessment Tax of Rs. 42,372 crore; Dividend Distribution Tax of Rs. 13,237 crore and Tax under other minor heads of Rs. 2,612 crore.

Despite an extremely challenging year, the Advance Tax collections for F.Y. 2020-21 stand at Rs. 4.95 lakh crore which shows a growth of approximately 6.7% over the Advance Tax collections of the immediately preceding Financial Year of Rs. 4.64 lakh crore.

Refunds amounting to Rs. 2.61 lakh crore have been issued in the F.Y. 2020-21 as against refunds of Rs. 1.83 lakh crore issued in the F.Y. 2019-20, marking an increase of approximately 42.1% over the preceding Financial Year.

The above figures are as yet provisional and subject to change pending final collation of data of collections.

Read More on CBDT