Capital requirements for NBFCs

Capital requirements for NBFCs

RBI/2022-23/30

DOR.CAP.REC.No.21/21.06.201/2022-23

April 19, 2022

Dear Sir/ Madam,

Scale Based Regulation (SBR) for NBFCs: Capital requirements for Non-Banking Finance Companies – Upper Layer (NBFC-UL)

Please refer to the circular DOR.CRE.REC.No.60/03.10.001/2021-22 dated October 22, 2021 on Scale Based Regulation (SBR): A Revised Regulatory Framework for NBFCs.

2. In terms of paragraph 3.2.1 (b) of the circular ibid, NBFC-UL shall maintain Common Equity Tier 1 capital of at least 9 per cent of Risk Weighted Assets. The detailed guidelines in this regard are provided below:

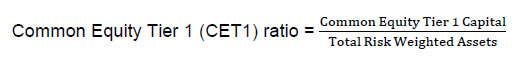

3.1. NBFC-UL shall maintain, on an on-going basis, Common Equity Tier 1 (CET1) ratio of at least 9 per cent, where,

3.2. Elements of Common Equity Tier 1 capital will comprise the following:

(i) Paid-up equity share capital issued by the NBFC

(ii) Share premium resulting from the issue of equity shares

(iii) Capital reserves representing surplus arising out of sale proceeds of assets

(iv) Statutory reserves

(v) Revaluation reserves arising out of change in the carrying amount of an NBFC’s property consequent upon its revaluation in accordance with the applicable accounting standards may, at the discretion of the NBFC, be reckoned as CET1 capital at a discount of 55%, instead of as Tier 2 capital under extant regulations, subject to meeting the following conditions:

- the property is held for own use, by the NBFC;

- the NBFC is able to sell the property readily at its own will and there is no legal impediment in selling the property;

- the revaluation reserves are presented/disclosed separately in the financial statements of the NBFC;

- revaluations are realistic, in accordance with applicable accounting standards;

- valuations are obtained, from two independent valuers, at least once in every 3 years;

- where the value of the property has been substantially impaired by any event, these are to be immediately revalued and appropriately factored into capital adequacy computations; and

- the external auditors of the NBFC have not expressed a qualified opinion on the revaluation of the property.

(vi) Other disclosed free reserves, if any.

Note: For Mortgage Guarantee Companies, free reserves include contingency reserves maintained as per paragraph 14(a) of the Master Directions – Mortgage Guarantee Companies (Reserve Bank) Directions, 2016 dated November 10, 2016.

(vii) Balance in Statement of Profit & Loss Account after allocations and appropriations i.e. retained earnings at the end of the previous financial year. Accumulated losses shall be reduced from CET 1.

(viii) Profits in current financial year may be included on a quarterly basis if it has been audited or subject to limited review by the statutory auditors of the NBFC. Further, such profits shall be reduced by average dividend paid in the last three years and the amount which can be reckoned would be arrived at as under:

EPt=NPt -0.25 *D*t

Where:

EPt=Eligible profit up to quarter ‘t’ of the current financial year, t varies from 1 to 4

NPt=Net profit upto quarter ‘t’

D=average dividend paid during the last three years

Losses in the current year shall be fully deducted from CET 1.

(ix) The following regulatory adjustments / deductions shall be applied in the calculation of CET1 capital [i.e. to be deducted from the sum of items (i) to (viii)]:

a) Goodwill and other intangible assets

- Goodwill and all other intangible assets should be deducted from Common Equity Tier 1 capital.

- The full amount of the intangible assets is to be deducted net of any associated deferred tax liabilities which would be extinguished if the intangible assets become impaired or derecognized under the relevant accounting standards. For this purpose, the definition of intangible assets would be in accordance with the relevant accounting standards. Losses in the current period and those brought forward from previous periods should also be deducted from Common Equity Tier 1 capital, if not already deducted.

b) Deferred Tax Assets (DTAs)

The following DTAs shall be deducted in full, from CET1 capital –

- DTAs associated with accumulated losses

- DTAs (excluding DTAs associated with accumulated losses) net of Deferred Tax Liabilities (DTL)

Note: Where the DTL is in excess of the DTA (excluding DTA associated with accumulated losses), the excess shall neither be adjusted against item (i) nor added to CET1 capital.1

c) Investment in shares of other non-banking financial companies and in shares, debentures, bonds, outstanding loans and advances including hire purchase and lease finance made to and deposits with subsidiaries and companies in the same group2 exceeding, in aggregate, ten per cent of the owned fund3 of the NBFC.

Note:

- The lower of acquisition cost or fair value of investments/advances shall be used to arrive at the amount of deduction mentioned above.

- For the purpose of the above deduction, margin money placed with a subsidiary or company in the same group shall be considered as deposits.

d) Impairment Reserve4 shall be not be recognised in CET1 capital.

e) Deductions/ exclusions, required on unrealised gains and/or losses from regulatory capital in terms of paragraphs 3(a) (i) to (iii) of the Annex to DOR (NBFC).CC.PD.No.109/22.10.106/2019-20 dated March 13, 2020 read with circular DOR(NBFC).CC.PD.No.116/22.10.106/2020-21 dated July 24, 2020 on “Implementation of Indian Accounting Standards”, shall be reduced from CET 1 capital.

f) Securitisation Transactions: NBFCs shall be guided by the Master Direction no. DOR.STR.REC.53/21.04.177/2021-22 dated September 24, 2021 titled Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021 in this regard.

g) Defined Benefit Pension Fund Assets and Liabilities: Defined benefit pension fund liabilities, as included on the balance sheet, must be fully recognised in the calculation of CET1 capital (i.e. CET 1 capital cannot be increased through derecognising these liabilities). For each defined benefit pension fund that is an asset on the balance sheet, the asset should be deducted in the calculation of CET1.

h) Investments in Own Shares (Treasury Stock): Investment in an NBFC’s own shares is tantamount to repayment of capital and therefore, such investments, whether held directly5 or indirectly, shall be deducted from CET1 capital. This deduction would remove the double counting of equity capital which arises from direct holdings, indirect holdings via index funds and potential future holdings as a result of contractual obligations to purchase own shares.

3.3. The Total Risk Weighted Assets (RWAs) to be used in the computation of CET1 ratio shall be the same as the total RWAs computed under the relevant Directions of the concerned NBFC category.

Applicability

4. This circular is applicable to all NBFCs identified as NBFC-UL, except Core Investment Companies (CICs).

5. CICs identified as NBFC-UL shall continue to maintain, on an on-going basis, Adjusted Net Worth as per the Master Direction DoR(NBFC).PD.003/03.10.119/2016-17 – Core Investment Companies (Reserve Bank) Directions, 2016 dated August 25, 2016.

Yours faithfully,

(Usha Janakiraman)

Chief General Manager

1 DTAs may be netted with associated deferred tax liabilities (DTLs) only if the DTAs and DTLs relate to taxes levied by the same taxation authority and offsetting is permitted by the relevant taxation authority. The DTLs permitted to be netted against DTAs must exclude amounts that have been netted against the deduction of goodwill, intangibles and defined benefit pension assets.

2 “Companies in the group”, shall mean an arrangement involving two or more entities related to each other through any of the following relationships: Subsidiary – parent, Joint venture, Associate, Promoter-promotee (as provided in the SEBI (Acquisition of Shares and Takeover) Regulations, 1997) for listed companies, a related party, Common brand name, and investment in equity shares of 20 per cent and above. The terms parent, subsidiary, joint venture, associate and related party shall be as defined/ described in applicable accounting standards.

3 “Owned Fund” will carry the same meaning as in the relevant Directions of the concerned NBFC.

4 Please refer to para 2(b) of Annex to circular no. DOR (NBFC).CC.PD.No.109/22.10.106/2019-20 dated March 13, 2020 on Implementation of Indian Accounting Standards, for guidelines on Impairment Reserve.

5 It may be noted that Section 67 of the Companies Act, 2013 restricts the purchase by a company or giving loans by it for purchase of its shares.

Read More on RBI