Gross GST revenue collected in the month of July 2022

₹1,48,995 crore gross GST revenue collected in the month of July 2022

GST Revenue collection for July second highest ever & 28% higher than the revenues in the same month last year

Posted On: 01 AUG 2022 11:26AM by PIB Delhi

The gross GST revenue collected in the month of July 2022 is

₹1,48,995 crore of which CGST is ₹ 25,751 crore, SGST is ₹ 32,807 crore, IGST is

₹ 79,518 crore (including ₹ 41,420 crore collected on import of goods) and cess is

₹ 10,920 crore (including ₹ 995 crore collected on import of goods). This is second highest revenue since introduction of GST.

The government has settled ₹ 32,365 crore to CGST and ₹ 26,774 crore to SGST from IGST. The total revenue of Centre and the States in the month of July 2022 after regular settlement is ₹ 58,116 crore for CGST and ₹ 59,581 crore for the SGST.

The revenues for the month of July 2022 are 28% higher than the GST revenues in the same month last year of ₹ 1,16,393 crore. During the month, revenues from import of goods was 48% higher and the revenues from domestic transaction (including import of services) are 22% higher than the revenues from these sources during the same month last year.

For five months in a row now, the monthly GST revenues have been more than ₹ 1.4 lakh core, showing a steady increase every month. The growth in GST revenue till July 2022 over the same period last year is 35% and displays a very high buoyancy. This is a clear impact of various measures taken by the Council in the past to ensure better compliance. Better reporting coupled with economic recovery has been having positive impact on the GST revenues on a consistent basis. During the month of June 2022, 7.45 crore e-way bills were generated, which was marginally higher than 7.36 crore in May 2022.

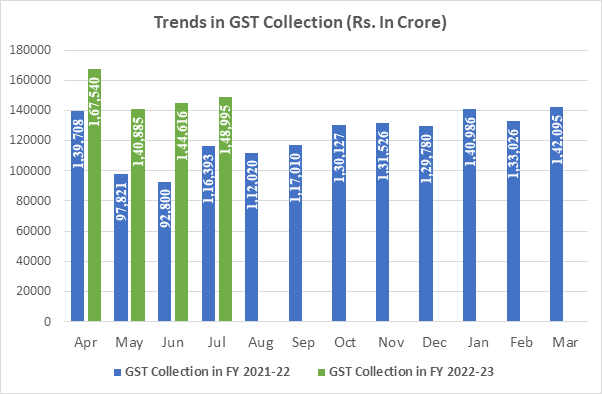

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of July 2022 as compared to July 2021.

State-wise growth of GST Revenues during July 2022[1]

| State | Jul-21 | Jul-22 | Growth |

| Jammu and Kashmir | 432 | 431 | 0% |

| Himachal Pradesh | 667 | 746 | 12% |

| Punjab | 1,533 | 1,733 | 13% |

| Chandigarh | 169 | 176 | 4% |

| Uttarakhand | 1,106 | 1,390 | 26% |

| Haryana | 5,330 | 6,791 | 27% |

| Delhi | 3,815 | 4,327 | 13% |

| Rajasthan | 3,129 | 3,671 | 17% |

| Uttar Pradesh | 6,011 | 7,074 | 18% |

| Bihar | 1,281 | 1,264 | -1% |

| Sikkim | 197 | 249 | 26% |

| Arunachal Pradesh | 55 | 65 | 18% |

| Nagaland | 28 | 42 | 48% |

| Manipur | 37 | 45 | 20% |

| Mizoram | 21 | 27 | 27% |

| Tripura | 65 | 63 | -3% |

| Meghalaya | 121 | 138 | 14% |

| Assam | 882 | 1,040 | 18% |

| West Bengal | 3,463 | 4,441 | 28% |

| Jharkhand | 2,056 | 2,514 | 22% |

| Odisha | 3,615 | 3,652 | 1% |

| Chattisgarh | 2,432 | 2,695 | 11% |

| Madhya Pradesh | 2,657 | 2,966 | 12% |

| Gujarat | 7,629 | 9,183 | 20% |

| Daman and Diu | 0 | 0 | -66% |

| Dadra and Nagar Haveli | 227 | 313 | 38% |

| Maharashtra | 18,899 | 22,129 | 17% |

| Karnataka | 6,737 | 9,795 | 45% |

| Goa | 303 | 433 | 43% |

| Lakshadweep | 1 | 2 | 69% |

| Kerala | 1,675 | 2,161 | 29% |

| Tamil Nadu | 6,302 | 8,449 | 34% |

| Puducherry | 129 | 198 | 54% |

| Andaman and Nicobar Islands | 19 | 23 | 26% |

| Telangana | 3,610 | 4,547 | 26% |

| Andhra Pradesh | 2,730 | 3,409 | 25% |

| Ladakh | 13 | 20 | 54% |

| Other Territory | 141 | 216 | 54% |

| Center Jurisdiction | 161 | 162 | 0% |

| Grand Total | 87,678 | 1,06,580 | 22% |

[1]Does not include GST on import of goods