GST revenue collection for April 2023 highest ever

GST revenue collection for April 2023 highest ever at Rs 1.87 lakh crore

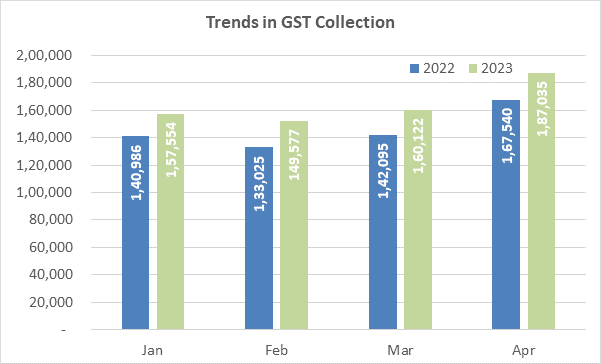

Gross GST collection in April 2023 is all time high, Rs 19,495 crore more than the next highest collection of Rs. 1,67,540 crore, in April 2022

GST revenues for April 2023 are 12% higher than the GST revenues Y-o-Y

Highest tax collected on a single day ever at ₹68,228 crore through 9. 8 lakh transactions on 20th April 2023

Posted On: 01 MAY 2023 5:46PM by PIB Delhi

The gross GST revenue collected in the month of April, 2023 is ₹ 1,87,035 crore of which CGST is ₹38,440 crore, SGST is ₹47,412 crore, IGST is ₹89,158 crore (including ₹34,972 crore collected on import of goods) and cess is ₹12,025 crore (including ₹901 crore collected on import of goods).

The government has settled ₹45,864 crore to CGST and ₹37,959 crore to SGST from IGST. The total revenue of Centre and the States in the month of April 2023 after regular settlement is ₹84,304 crore for CGST and ₹85,371 crore for the SGST.

The revenues for the month of April 2023 are 12% higher than the GST revenues in the same month last year. During the month, the revenues from domestic transactions (including import of services) are 16% higher than the revenues from these sources during the same month last year.

For the first time gross GST collection has crossed ₹1.75 lakh crore mark. Total number of e-way bills generated in the month of March 2023 was 9.0 crore, which is 11% higher than 8.1 crore e-way bills generated in the month of February 2023.

Month of April 2023 saw the highest ever tax collection on a single day on 20th April 2023. On 20th April 2023, ₹ 68,228 crore was paid through 9. 8 lakh transactions. The highest single day payment last year (on the same date) was

₹ 57,846 crore through 9.6 lakh transactions.

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of April 2023 as compared to April 2022.

State-wise growth of GST Revenues during April 2023[1]

| State/UT | Apr-22 | Apr-23 | Growth (%) |

| Jammu and Kashmir | 560 | 803 | 44 |

| Himachal Pradesh | 817 | 957 | 17 |

| Punjab | 1,994 | 2,316 | 16 |

| Chandigarh | 249 | 255 | 2 |

| Uttarakhand | 1,887 | 2,148 | 14 |

| Haryana | 8,197 | 10,035 | 22 |

| Delhi | 5,871 | 6,320 | 8 |

| Rajasthan | 4,547 | 4,785 | 5 |

| Uttar Pradesh | 8,534 | 10,320 | 21 |

| Bihar | 1,471 | 1,625 | 11 |

| Sikkim | 264 | 426 | 61 |

| Arunachal Pradesh | 196 | 238 | 21 |

| Nagaland | 68 | 88 | 29 |

| Manipur | 69 | 91 | 32 |

| Mizoram | 46 | 71 | 53 |

| Tripura | 107 | 133 | 25 |

| Meghalaya | 227 | 239 | 6 |

| Assam | 1,313 | 1,513 | 15 |

| West Bengal | 5,644 | 6,447 | 14 |

| Jharkhand | 3,100 | 3,701 | 19 |

| Odisha | 4,910 | 5,036 | 3 |

| Chhattisgarh | 2,977 | 3,508 | 18 |

| Madhya Pradesh | 3,339 | 4,267 | 28 |

| Gujarat | 11,264 | 11,721 | 4 |

| Dadra and Nagar Haveli and Daman and Diu | 381 | 399 | 5 |

| Maharashtra | 27,495 | 33,196 | 21 |

| Karnataka | 11,820 | 14,593 | 23 |

| Goa | 470 | 620 | 32 |

| Lakshadweep | 3 | 3 | -7 |

| Kerala | 2,689 | 3,010 | 12 |

| Tamil Nadu | 9,724 | 11,559 | 19 |

| Puducherry | 206 | 218 | 6 |

| Andaman and Nicobar Islands | 87 | 92 | 5 |

| Telangana | 4,955 | 5,622 | 13 |

| Andhra Pradesh | 4,067 | 4,329 | 6 |

| Ladakh | 47 | 68 | 43 |

| Other Territory | 216 | 220 | 2 |

| Center Jurisdiction | 167 | 187 | 12 |

| Grand Total | 1,29,978 | 1,51,162 | 16 |