Amendments to provisions in SEBI Circular dated September 16, 2016 on Unique Client Code (UCC) and mandatory requirement of Permanent...

Read MoreHome

What's New

Campus Updates- Virtual Interview with ICICI Bank

CA Cult – 9 March 2021

Campus Updates- Virtual Interview with ICICI Bank This is with reference to the virtual campus interviews being held at Delhi,...

Read MoreAction initiated to control fraudulent companies

CA Cult – 9 March 2021

Action initiated to control fraudulent companies Posted On: 09 MAR 2021 1:36PM by PIB Delhi The term ‘Fraudulent Company’ is...

Read MoreIBBI organises Seminar on the occasion of International Women’s Day

CA Cult – 8 March 2021

IBBI organises Seminar on the occasion of International Women's Day. To mark the occasion of International Women's Day, the Insolvency...

Read MoreNotification No. 05/2021- Central Tax

CA Cult – 8 March 2021

Notification No. 05/2021– Central Tax: Seeks to implement e-invoicing for the taxpayers having aggregate turnover exceeding Rs. 50 Cr from...

Read MoreUdyam registration (MSME) further simplified

CA Cult – 8 March 2021

Udyam registration (MSME) further simplifiedUdyam Portal , a roaring success with enterprises, crosses 25 lakh registrations Posted On: 08 MAR...

Read MoreIBBI gives approval to 317 companies’ resolution plans

CA Cult – 8 March 2021

IBBI gives approval to 317 companies’ resolution plans; 1,126 companies to be liquidated Posted On: 08 MAR 2021 6:28PM by...

Read MoreDisputes amounting to Rs. 98,328 crore are resolved under VSVS

CA Cult – 8 March 2021

Disputes amounting to Rs. 98,328 crore are resolved under Vivad se Vishwas Scheme (VSVS) till 1st March 2021 Posted On:...

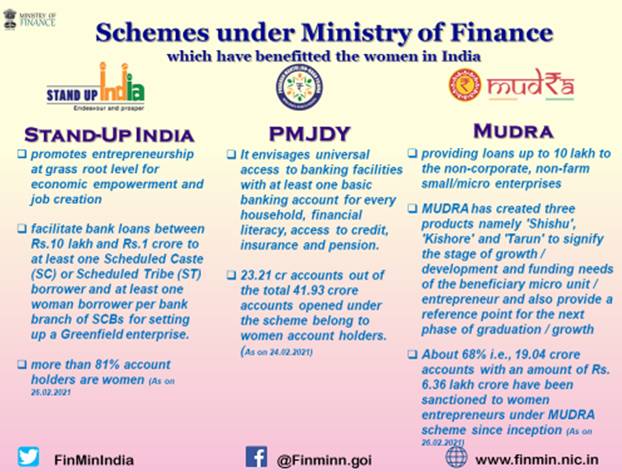

Read More81% account holders are Women under Stand Up India Scheme

CA Cult – 8 March 2021

More than 81% account holders are Women under Stand Up India SchemeMUDRA:68% of loan accounts belong to women entrepreneursPMJDY:23.21 crore...

Read MoreMCA strikes off 10,113 companies- News and Updates

CA Cult – 8 March 2021

MCA strikes off 10,113 companies between April 2020 and February 2021 Posted On: 08 MAR 2021 6:30PM by PIB Delhi...

Read MoreBlogs

- Tax-Efficient Investing in 2025: ELSS vs NPS vs PPF

- CBDT Notifies Updated Return Filing Provisions (ITR-U)

- Companies (Indian Accounting Standards) Amendment Rules, 2025

- Reporting of HSN codes and list of documents in GSTR-1/1A

- TCS on outward remittance under LRS, effective April 1, 2025

- Declaration by registered supplier of hotel accommodation service

- Changes in GST and Income Tax during the Financial Year 2024-25

- TDS and TCS provisions applicable from April 1, 2025

- Understanding the Electronic Invoicing (e-Invoicing) in GST

- Direct Tax Code 2025: Simplifying India’s Taxation System